The medical devices/equipment market has had exponential growth in recent years and Brazil’s market for these products offers significant growth opportunities for global players. As the largest economy in South America, Brazil spends around 8% of its total GDP on healthcare. According to MarketResearchFuture, Brazil’s medical devices market is expected to reach a value of US$1.8 billion by 2023, with a compound annual growth rate (CAGR) of 9% projected for 2017-2023. Innovation and new technologies have led this healthcare segment, and particularly it’s been technological advancements that have led to the launch of high-tech medical devices that have totally revolutionized the perception of healthcare, as in the case of PET/MR systems.

As observed by Global Health Intelligence (GHI) in a report published in April 2021, Brazil has experienced solid growth in its healthcare industry and Brazilian hospitals significantly increased their amounts of base installed equipment in 2020, with the strongest growth occurring with ventilators, EKG machines and infusion pumps. The urgent needs caused by the COVID-19 pandemic could explain the growth with these product categories, but the report also shows growth with other categories.

Going forward, data from GHI’s HospiScope database suggests further expansion is on the way in 2022. Below we break down 10 categories of medical equipment with the highest projected growth in 2022, along with 5 categories projected to have the biggest contractions next year.

The 10 Medical Equipment Categories with the Greatest Projected Growth in Brazil in 2022

Ventilatorsin Brazil’s hospitals

Projected 9% increase in 2022

EKG machinesin Brazil’s hospitals

Projected 7% increase in 2022

PET/MR systems in Brazil’s hospitals

Projected 7% increase in 2022

Infusion pumps in Brazil’s hospitals

Projected 6% increase in 2022

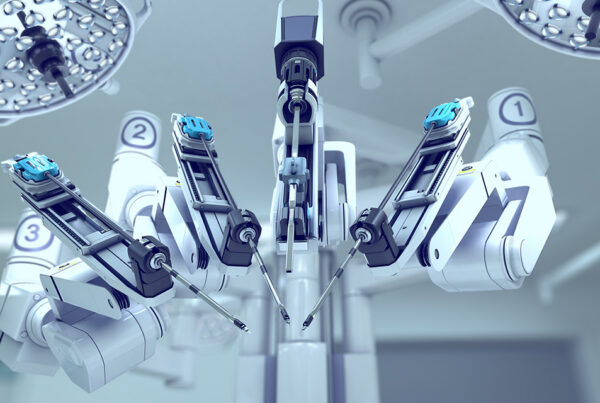

Laparoscopic surgery equipment in Brazil’s hospitals

Projected 6% increase in 2022

Ultrasound machines in Brazil’s hospitals

Projected 6% increase in 2022

Fluoroscopes in Brazil’s hospitals

Projected 5% increase in 2022

Endoscopy machines in Brazil’s hospitals

Projected 4% increase in 2022

Incubators in Brazil’s hospitals

Projected 4% increase in 2022

Radiant heat cribs in Brazil’s hospitals

Projected 4% increase in 2022

The 5 Medical Equipment Categories with the Greatest Projected Contraction in Brazil in 2022

X-ray machines in Brazil’s hospitals

Projected 2% contraction in 2022

Stereotactic mammography machines in Brazil’s hospitals

Projected 1% contraction in 2022

Gamma cameras in Brazil’s hospitals

Projected 1% contraction in 2022

EEG machines in Brazil’s hospitals

Projected 1% contraction in 2022

Angiograms in Brazil’s hospitals

Projected 1% contraction in 2022

Next Steps

Contact us to obtain more detailed data on the medical equipment market in Brazil. We can help with several key resources, such as:

HospiScope: Subscribing to this database allows you to access millions of data points for nearly 90% of the hospitals in Latin America.

SurgiScope: Subscribing to this database allows you to see the surgical procedures taking place in hospitals in LatAm’s key hospital markets, which in turn can be used to gauge market demand for your products, market projections and more.

ShareScope: This service reveals market share in different markets for more than 30 different types of medical equipment.

LatAm Hospital Monitoring Service: Subscribing to this service gives you weekly updates on Latin American hospitals in the country of your choice, all accessible through a power business intelligence platform that features cutting-edge data visualization tools.

In-Scope: Customized research into the LatAm medical equipment market of your choice that will deliver a proprietary report offering the insights you need to make strategic decisions in 2022 and beyond.