Budget crunch: government belt-tightening offers opportunities for companies to fill health care gaps

As they strive to provide healthcare to large populations characterized by vast income disparities, Latin American governments struggle with the tradeoffs between accessibility and quality of care. Brazil, for instance, possesses some of the region’s most renowned healthcare institutions, but the majority of the country’s public healthcare system suffers from poor planning and understaffing. With few exceptions, most Brazilians complain of long wait times in the public system.1

Mexico also faces challenges with a lack of public-private partnerships and poor distribution of resources — public institutions often overlap by geography and unnecessarily duplicate services; they also have yet to reach a consensus on patient portability.2 These legacy systems fall well short of addressing the growing healthcare pressures of an ageing population.

The lack of infrastructure and misallocation of resources nevertheless offers opportunities for the private sector, especially in countries such as Brazil, Mexico, Chile, and Colombia, where healthcare expenditures are rising. Companies who can offer high-quality care and treatment at a reasonable cost stand to make significant gains.3

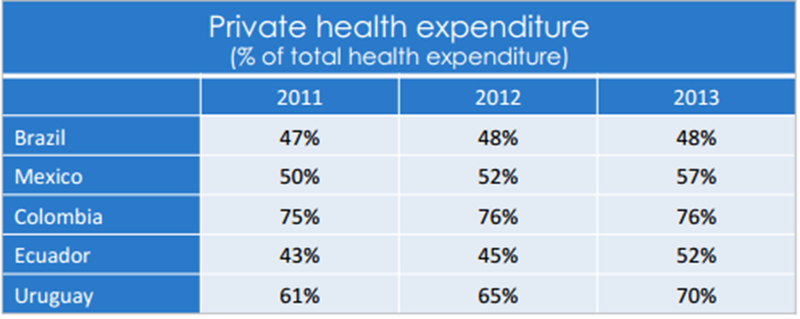

Source: The World Bank

Source: The World Bank

However, private sector providers face challenges of their own. Private institutions in Mexico, for example, face a shortage of nurses because they offer lower wages and benefits compared to the pay on offer in the public sector.2

While there is no perfect solution, governments can set the stage for private companies to complement — and in some cases offset — rigid and slow public health systems. Rules and regulations will need to evolve as a result, and already some countries have set up new frameworks to enable greater private participation in healthcare provision. Encouraging local solutions and alternatives to imports is particularly relevant given weakening currencies and grim economic outlook expected until 2018.

- Leading this trend is Brazil, where in early 2015 President Roussef announced that foreign companies could invest in private hospitals, thus helping to expand private care and shifting part of the financial burden away from the public sector. Private equity funds Carlyle Group and GIC Holdings invested over $600 million in the Rede D’Or São Luiz hospital chain, to construct new hospitals and expand current facilities.4

- IFC recently helped expand Brazil’s outpatient service centers for its third largest diagnostic imaging company, and has also provided telemedicine services to Colombians in remote areas.5

- Management Sciences for Health (MSH) received funding to provide technical assistance to Mexico, Nicaragua, Honduras, and other countries throughout the region to increase access to integrated health services.6

- Telemedicine gained traction in Argentina throughout 2015. Through the recently launched National CyberHealth Plan, Argentina is developing a connected network of hospitals. The country is taking advantage of this new infrastructure to pioneer new technologies such as tele-ultrasounds and tele-resonance scans. Private companies like Philips are investing in this field by expanding the number of Picture Archiving and Communication Systems (PACS), a remote-radiology service, in Brazil and introducing them into Argentina. 7-8

“…Private companies and entrepreneurs will take over a lot of government functions, sparking huge opportunities to profit from a vast population that won’t mind paying to get the service they deserve — mostly in health care…”

Luis Arnal, President and Founder of INSITUM

These initiatives, though principally driven by cost-efficiency concerns, also reveal a desire to transition toward (1) a cloud-based framework and (2) patient-centric healthcare. Suppliers involved with connectivity, health IT, and diagnostic imaging will be able to capitalize on regional trends to expand in these fields. Private institutions, in turn, are expected to step in and complement the public sector’s shortcomings with offerings geared to the “middle market consumers” – products and services geared to those who want access to better healthcare at reasonable cost.

www.globalhealthintelligence.com 6