Guillaume Corpart

Though they are not a new medical technology, biopharmaceuticals, also known as biologics, have significantly expanded in recent years and are continuing to evolve in their potential to treat illnesses such as cancer, diabetes, and more. While traditional drugs are created via chemical means and are made up of small molecules, biopharmaceuticals are made from living cells, proteins, tissues, or nucleic acids. They typically have larger molecules than traditional pharmaceuticals and are often administered via injection.

More about Biopharmaceuticals

Biopharmaceuticals made headlines a few years ago with the rapid development of the COVID-19 vaccine, but that’s far from the only type of biopharmaceutical in regular use. Types of biopharmaceuticals include:

- One of the original biopharmaceuticals, vaccines have helped eradicate diseases around the world, such as smallpox and measles, among others.

- Monoclonal antibodies (mAbs). These drugs mimic the immune system and target specific proteins to block their activity or destroy them. They are used in the treatment of autoimmune disease and some cancers.

- Gene therapy. These medications can cure or treat genetic or infectious diseases by introducing genetic material into the patient’s cells. They have been used to treat retinal diseases, spinal muscular atrophy, and more.

- Cell therapy. These treatments include stem cell transplants and involve modifying cells to enhance or restore their function. They can treat leukemia, lymphoma, and other degenerative disorders.

- Recombinant proteins. These proteins are grown inside living cells and include enzymes, hormones, and cytokines that are used to treat diseases ranging from hemophilia to diabetes.

Vaccines in Latin America

In years past, Latin America was often reliant on other regions to provide vaccines and other biopharmaceuticals. This became problematic in the wake of the COVID-19 pandemic, when only 15 percent of vaccines were locally produced. This led to vaccination rates below 25 percent in some countries, such as Guatemala, Venezuela, and Honduras, in October 2021.

Luckily, the region took this development as a “lessons learned” moment and has made great strides in easing regulations and promoting the production of both vaccines and other pharmaceuticals since then. In September 2021, the Pan American Health Organization (PAHO) approved the Special Program, Innovation and Regional Production Platform, aiming to increase the production capacity for essential medicines and health technologies across Latin America. The Forum for the Project and Development of South America (PROSUR) is another organization that is pushing similar efforts forward.

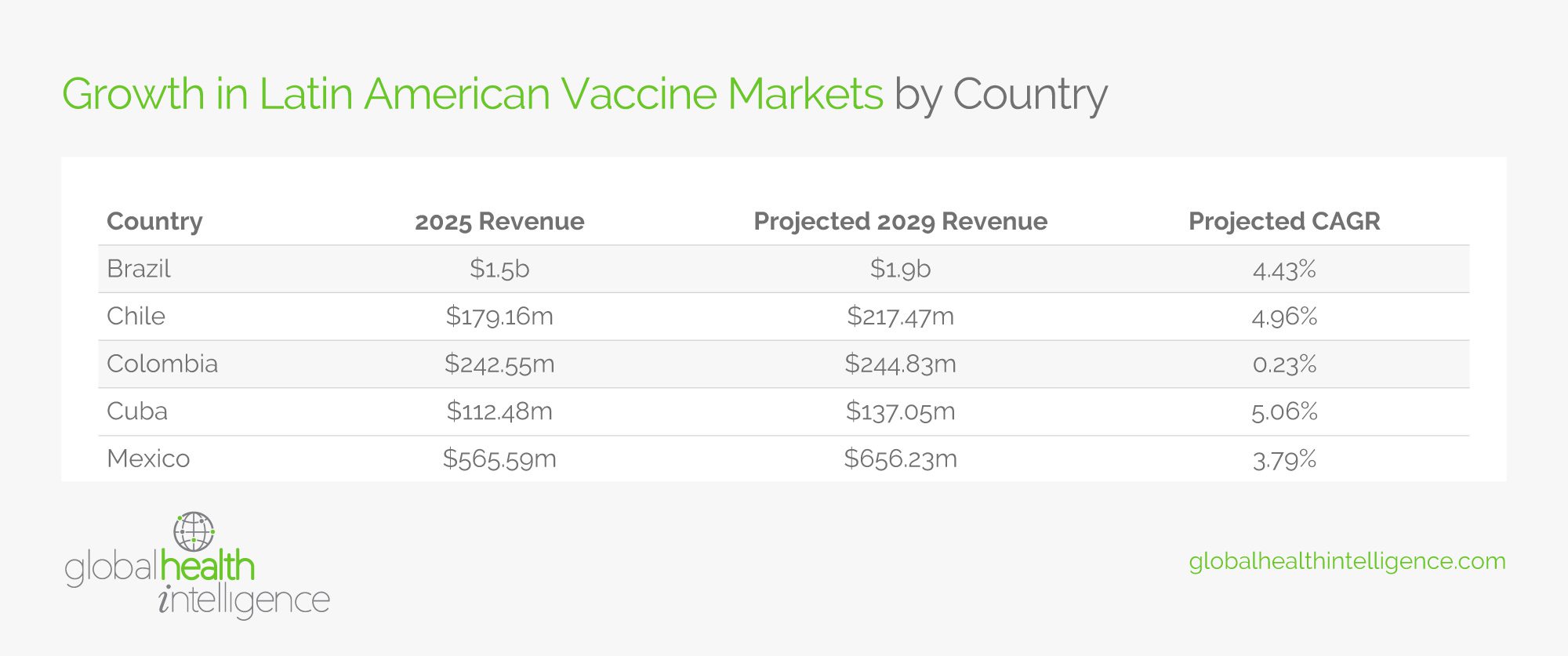

These efforts are already beginning to pay dividends across the region. For example, in July 2024, the Brazilian vaccine manufacturer Bio-Manguinhos/Fiocruz joined CEPI’s network of vaccine manufacturers to help create faster and more equitable responses to future disease threats. This growth appears to be region-wide, with countries such as Mexico, Colombia, Chile, and more expected to see growth in the vaccine market in the upcoming years. You can find more data in the table below.

Easing Regulations on Other Biopharmaceuticals

Aside from vaccines, Latin American regulatory agencies are also making efforts to speed up and streamline the process of biopharmaceutical approvals. This should result in a better environment for companies trying to bring drugs to those markets.

In Brazil, for example, the Brazilian Health Regulatory Agency, ANVISA, began implementing a new resolution on January 21 to simplify the process of introducing biological products, including vaccines, radiopharmaceuticals, and generic drugs. It also makes corrections, new indications, withdrawals, and other processes around pharmaceuticals easier to navigate. To be eligible for this simplified process, companies must have at least one other drug or biological product already approved in the Brazilian market.

Other markets in Latin America, including the Dominican Republic and Colombia, have announced similar measures in recent months. In July 2024, Argentina announced several related measures to ease restrictions on pharmaceuticals, including allowing more generic drugs to enter the marketplace, easing barriers to opening new pharmacies, and permitting the sale of over-the-counter medications in businesses other than pharmacies.

Mexico has undergone similar efforts to promote clinical research and enhance access to generic and biosimilar medicines. Interestingly, Mexico’s efforts appear to be targeting not only local access, but also the availability of these medications in markets such as the United States. What this means for pharmaceutical manufacturers is potentially more friendly and open markets for new or generic versions of drugs in the years ahead.

An Increase in Manufacturing

As these regulatory changes indicate, Latin America is “all in” on the biopharmaceuticals market, and these regulatory changes are already beginning to pay dividends. The Center for Global Development notes that many middle-income countries, including Brazil, have already become essential players as global vaccine suppliers. As production continues to ramp up across the region, it’s possible that other countries could follow suit as important players in the worldwide vaccine market.

The other component of the rise in biopharmaceutical manufacturing in Latin America is the role of biosimilars and generic drugs. As specialty medications have grown more expensive, the availability of more affordable generic alternatives has become critical for many people in the region who need them. The easing of regulatory restrictions in countries such as Brazil, Argentina, Colombia, and more has made it easier to bring these drugs to market.

As the market for these medications has expanded in Latin America, so too has the pool of talented professionals looking to work in these industries. Many students are now pursuing biotechnology as their desired profession, leading to an influx of scientists and other skilled professionals who continue to drive innovation in the field.

For a closer look at how the biopharmaceutical industry is growing in Latin America, check out the table below:

Clinical Trials in Latin America

One offshoot of the growth of biopharmaceuticals in Latin America is the explosion of clinical trials in the region. Latin America is now the world’s fourth-largest clinical trials market and is seeking to quadruple participation in the coming years. Around 70 percent of the trials take place in Argentina, Brazil, Chile, Colombia, Mexico, and Peru.

Experts cite Latin America’s diverse patient population, lower operational costs, and improved regulatory framework as reasons that clinical trials have begun to grow substantially in the region. This development has further contributed to Latin America’s growing role as an innovator in the biopharmaceutical market.

Key Takeaways for Health Care Companies

With the easing of restrictions and the efforts to ramp up manufacturing and clinical trials across the Latin American region, pharmaceutical manufacturers are well-positioned to take advantage of these regulatory and market changes in the months and years ahead.

If you’re a major multinational pharmaceutical company with a significant market presence in the region, you should continue to see growth due to the streamlined processes many countries are implementing to review, approve, and add drugs to the marketplace. One interesting challenge for these larger manufacturers in the coming years may stem from increased competition, as more generic drugs and biosimilars from smaller manufacturers enter the market. Larger companies can stay ahead of the curve by staying agile and continuing to push for innovation in the biopharmaceutical sector.

Next Steps

Contact GHI to learn more about healthcare trends and their potential impact on the biopharmaceutical industry in Latin America. Our team of researchers can provide the analysis you need to gain valuable insights to support strategic decision-making in your industry.

Sources:

- https://www.path.org/l/diagnostic-and-vaccine-manufacturing-capacity-in-latin-america/

- https://www.paho.org/en/special-program-innovation-and-regional-production-platform-rp

- https://cepi.net/mobilising-brazils-manufacturing-might-support-vaccine-production-global-south

- https://www.statista.com/outlook/hmo/pharmaceuticals/vaccines/guatemala

- https://www.elsevier.es/en-revista-vacunas-english-edition–259-articulo-latin-american-participation-in-scientific-S2445146022000267?covid=Dr56DrLjUdaMjzAgze452SzSInMN&rfr=truhgiz&y=kEzTXsahn8atJufRpNPuIGh67s1

- https://tdtmvjournal.biomedcentral.com/articles/10.1186/s40794-021-00135-5

- https://www.raps.org/news-and-articles/news-articles/2025/1/latin-america-roundup-agencies-continue-shift-to-o

- https://scigeniq.com/the-evolving-regulatory-landscape-for-latin-american-pharma-companies/

- https://www.dlapiper.com/en/insights/publications/2024/07/argentina-deregulates-healthcare-and-pharmaceutical-industries

- https://www.drugpatentwatch.com/blog/the-growing-importance-of-specialty-generics-in-the-latin-american-pharmaceutical-market/#:~:text=The%20Latin%20American%20pharmaceutical%20market%20has%20been%20experiencing%20significant%20growth,effective%20alternative%20to%20branded%20pharmaceuticals

- https://www.cambridge.org/core/journals/journal-of-law-medicine-and-ethics/article/pharmaceutical-market-for-biological-products-in-latin-america-a-comprehensive-analysis-of-regional-sales-data/6AE11D8A159BD46B0CA243A1BAC709A7

- https://www.raps.org/news-and-articles/news-articles/2024/3/latin-america-roundup-brazil-and-colombia-advance

- https://www.languageconnections.com/clinical-trials-in-latin-america/

- https://www.thepharmaletter.com/pharmaceutical/latin-america-seeks-to-quadruple-its-participation-in-clinical-trials

- https://www.bioaccessla.com/blog/why-latin-america-leads-in-clinical-trials-exploring-the-key-factors