While the attention of the industry may focus a bit more on markets like Mexico and Brazil, it’s important to note that Colombia has more than 2,700 hospitals and offers interesting growth potential for medical equipment and device manufacturers. Here’s why:

While penetration rates in Colombian hospitals are high for common equipment types such as EKG machines, there is room to grow the market with other equipment types. In fact, when we look at data projections from our HospiRank 2020 report, we see the following types of medical equipment and devices as having the biggest projected growth from 2019 through 2023 in Colombia:

Medical equipment types with the highest projected growth between 2019 and 2013 include a majority of the equipment which currently has low penetration, such as:

- Linear accelerators, projected to grow by 31% in Colombian hospitals 2019-2023

- MRI machines, projected to grow by 20% in Colombian hospitals 2019-2023

- Endoscopy towers, projected to grow by 18% in Colombian hospitals 2019-2023

- Hemodialysis machines, projected to grow by 18% in Colombian hospitals 2019-2023

- Fluoroscopes, projected to grow by 8% in Colombian hospitals 2019-2023

- CT scanners, projected to grow by 6% in Colombian hospitals 2019-2023

Going further

Contact us for a customized study if you’d like to understand market drivers with Colombian healthcare, know the top brands by market share and other data that can help you target your product launches with this market more effectively.

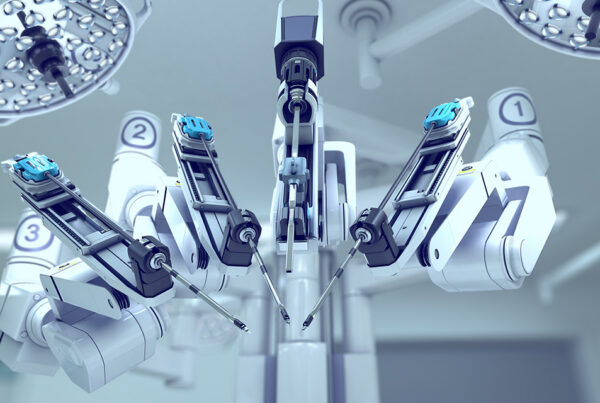

For a full list of growth/contraction rates more than 30 equipment types in Colombia, a ranking of the best-equipped hospitals in Colombia in 8 categories, breakdowns by hospital of the amounts of surgery robots in Latin America and more, you can purchase our HospiRank 2020 report.

For granular medical equipment market data on Colombia and other key LatAm markets, you can purchase our Medical Equipment Market Report: Latin America 2020.

Either of these reports offer in-depth, exclusive numbers that are unavailable in any other market research report in the world, given that Global Health Intelligence is the only company that obtains and analyzes infrastructure data that comes directly from the hospitals themselves.