By Guillaume Corpart

The impact of the COVID-19 pandemic on global and regional healthcare markets was unquestionably complex. To date, we are still sorting through the full impact. One thing that has become clearer, however, is a fundamental shift in how medical equipment importers in Latin America sourced their products.

A shift toward Asia

When you begin to crunch the import and export numbers, one post-pandemic shift becomes evident: Asian importers gained ground in Latin America, while the United States lost ground. There are a few reasons behind this shift, but the complexity of sourcing products during the pandemic may have opened the door for Asia to grow their presence.

A closer look at the numbers

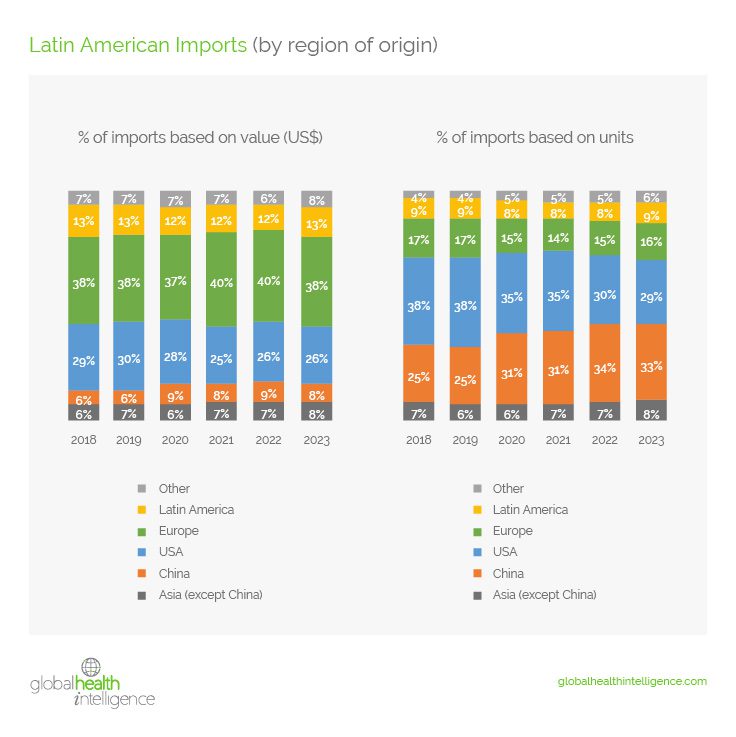

Imports are measured both in their overall value in U.S. dollars, as well as their quantity of units sold. In both cases, the statistics show significant gains by Asian suppliers.

Import Value:

- Asian products represented 12% of the value of all Latin American imports for medical products before COVID and grew to represent 16% in 2023.

- In contrast, the value share of products from the U.S. dropped from 29% to 26% over the same period.

- All other regions (Europe, other Latin American countries, and other geographies) remained stable.

Import Volume:

- Asian products represented 32% of the volume of all Latin American imports for medical products before COVID and grew to represent 41% in 2023.

- China is the main beneficiary of this trend, growing its share of imports from 25% in 2018 to 33% in 2023, while the rest of Asia remained relatively stable.

- In contrast, the volume share of products from the U.S. dropped from 38% to 29% over the same period.

- All other regions (Europe, other Latin American countries, and other geographies) remained stable.

SEE YOUR SHARE

Get market share data for everything from capital equipment and consumables to medical devices and drugs

Key takeaways

The data shown clearly supports a trend of growing Chinese medical imports into Latin American markets, to the detriment of American products. When you analyze the discrepancy between the volume and value of these imports, that also supports the idea that China is introducing more goods at lower prices. As you’ll see when we do the country-by-country breakdowns, some countries and product categories are more heavily impacted by these trends than others.

Research parameters

The following product category imports from 2018-2023 were included in our analysis of trends:

- 3004 medicaments (consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses or in forms or packings for retail sale).

- 3005 dressings (wadding, gauze, bandages, and the like, impregnated or covered with pharmaceutical substances or put up for retail sale for medical, surgical, dental, or veterinary purposes).

- 3006 pharmaceutical preparations (and products).

- 8421.29 machines and apparatuses for filtering or purifying liquids (excluding machinery and apparatuses for water and other beverages, oil or petrol-filters for internal combustion engines, and artificial kidneys).

- 8421.39 machines and apparatuses for filtering or purifying gases (excluding isotope separators and intake air filters for internal combustion engines and catalytic converters and particulate filters for purifying or filtering exhaust gases from internal combustion engines).

- 8421.99 parts of machines and apparatuses (for filtering or purifying liquids or gases).

- 9018 instruments and appliances used in medical, surgical, dental, or veterinary sciences (including scintigraphic apparatuses, other electro-medical apparatuses, and sight-testing instruments).

- 9019 mechano-therapy appliances, massage apparatuses, psychological aptitude-testing apparatuses, ozone therapy, oxygen therapy, aerosol therapy, artificial respiration (or other therapeutic respiration apparatuses).

- 9021 orthopedic appliances (including crutches, surgical belts and trusses; splints and other fracture appliances; artificial parts of the body; hearing aids; and other appliances that are worn, carried, or implanted in the body to compensate for a defect or disability).

- 9022 apparatuses based on the use of X-rays or of alpha, beta, gamma, or other ionizing radiation, whether or not for medical, surgical, dental, or veterinary uses (including radiography or radiotherapy apparatuses, X-ray tubes and other X-ray generators, high-tension generators, control panels and desks, screens, examination, or treatment tables, chairs, and the like).

In the next installment of this article, we’ll break down the shifting import trends in the following Latin American nations:

- Brazil

- Mexico

- Colombia

- Argentina

- Chile

Next steps

Contact GHI if you want further information or a custom research solution to help you uncover critical data and valuable insights from the Latin American medical equipment and supply industries.