By Guillaume Corpart

When it comes to medical imports in the Latin American healthcare market, there’s no question that Asia in general, and China more specifically, has become a major player, particularly since the COVID-19 pandemic of 2020. In a previous article, we explored their growing presence in detail.

However, it also helps to dig deeper into which medical products represent the highest growth for Chinese medical equipment manufacturers. Orthopedic appliances in particular seem to be growing at a high level, but they’re far from the only device and supply market that’s worth keeping an eye on.

How We Got Here

Asian medical imports have been part of the fabric of the Latin American healthcare market for years, but the rapid growth of recent times really began with the COVID-19 pandemic. The resulting fallout set the medical world on high alert and scrambling for resources, PPE (personal protection equipment) and medical products.

As care providers sought to fill their needs, supply chains diversified. They began looking to new suppliers in foreign markets to get products of any kind. Chinese manufacturers rose to the challenge, manufacturing equipment at breakneck speeds and reducing costs.

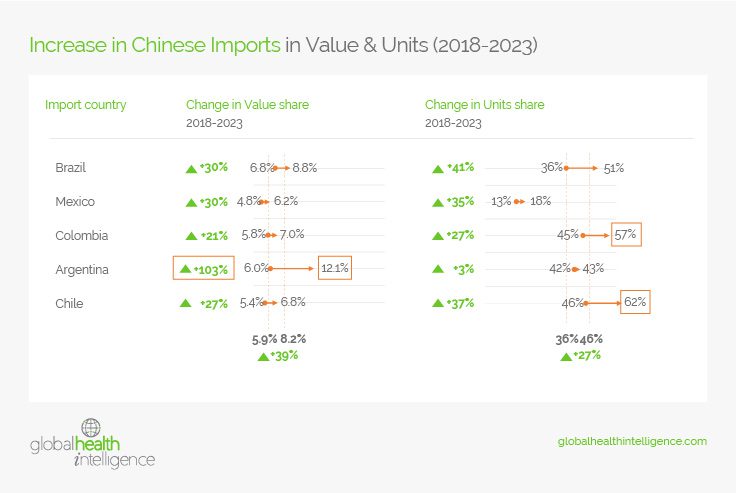

Along with PPE and the specific needs for COVID-19, the medical device and equipment market was also growing rapidly at the same time. Overall, from 2018 to 2023, medical device and equipment imports into Latin America from China grew 27% in total units and 39% in total value. China is a major player in the Latin American market, where over 50% of all medical supplies imported into Brazil, Colombia, and Chile now come from China (refer to the chart below).

Recently, we’ve seen another trend in Chinese imports along with their rapid growth in the region. While Chinese products were typically low-cost alternatives to other medical products, they are now moving up the value scale. Many could now be considered value-based products instead of simply low-cost products. We are also seeing the emergence of innovative technology Chinese players that can compete head-on with other global brands.

A closer look at the numbers

While a rapid expansion of Chinese products across the region is occurring, the rate of increase varies across markets and based on product type. Chinese products have major traction already in Chile, Colombia, and Brazil, and their presence in those countries continues to grow.

Other countries have not been affected as greatly by the influx of Chinese medical supplies, however. For example, Peru and Mexico have managed to keep their rates of Chinese imports relatively low in comparison with other countries in the region. Take a look at the table below for an in-depth breakdown of the growth of Chinese products across the largest Latin American countries from 2018 to 2023.

Chinese imports by product category

China has also gained a massive foothold with certain product categories. The following are the areas that have seen the greatest growth since 2018:

- Machines and apparatuses for filtering or purifying liquids, such as centrifuges and filtration machines. Leading importers include Baxter, Nipro, and Fresenius, among others.

- Orthopedic appliances, such as orthopedic implants, hearing aids, stents, catheters, pacemakers, and prosthetic limbs and joints. Leading importers include Medtronic, Edwards Lifesciences, Smith & Nephew, Johnson & Johnson, Biomet, Boston Scientific, and Alcon, among others.

- Apparatuses based on the use of X-rays or of alpha, beta, gamma, or other ionizing radiation, such as X-ray equipment, tomography scanners, and MRI systems. Leading importers include Siemens Healthineers, Philips, and GE Healthcare, among others.

Key takeaways for suppliers

The bottom line for Chinese products in Latin America is that you can expect continued growth, as well as the expansion of Chinese products into other product categories in the coming years. Considering this, established medical device and equipment manufacturers must find innovative ways to compete against these new competitors.

One important strategy for differentiating your products from Chinese competitors is to focus on specific product elements that may be lacking among Chinese products, such as the following:

- Logistics

- Warranties

- Replacement parts

- Portfolio diversification

- Clinical evidence around outcomes and reliability

- Physician certifications

High-quality products and devices that focus on these core elements can give you an edge that may limit the impact of new entrants in the market. However, it’s critical to act fast, before these players establish a stable foothold in the market.

For more information

Contact GHI for a detailed analysis of your product category, as well as to understand market size and market share trends by product.