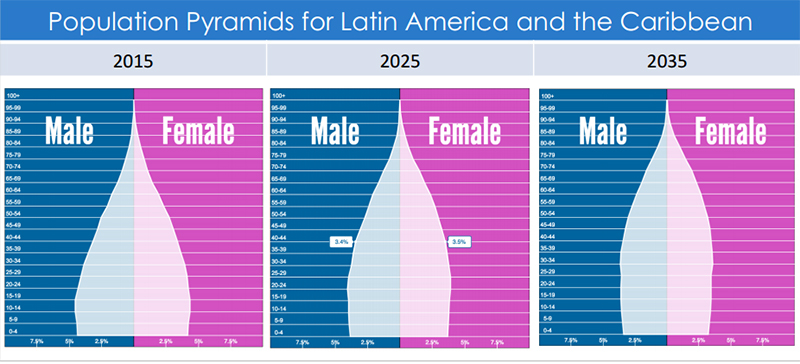

Latin America is experiencing steady and significant ageing of its population – largely driven by the expansion and modernization of healthcare provision and the ensuing rise in life expectancy. The confluence of continued technological progress and dropping fertility rates has led to growing concerns about the sustainability of all publicly financed social welfare programs, particularly healthcare.

Latin America’s geriatric base is a pressing issue for healthcare systems, both public and private. In 2010, 10% of the region’s population was over 60 years old. By 2040, this number is expected to more than double, reaching 21%.1 The phenomenon is not unique to Latin America – other countries dealing with similar issues include the United States (where projections indicate that 22% of the population will be over 60 by 2040) and Japan (where 25% of the population is currently over 60 years old).2,3 The burden of ageing demographics has led the Japanese healthcare system into a crisis, which serves as a cautionary tale to even the best managed health care systems elsewhere.

As the number of working-age adults decreases as a proportion of the total population, the ageing of the population will result in a net economic burden, particularly when considering that seniors account for a disproportionate amount of healthcare costs. These costs will be partially responsible for Latin America’s expected rise in healthcare expenditures, increasing an average of 4.6% per year through 2018.4

Chronic diseases are the principal cost driver associated with ageing population, as over 80% of adults over 60 have at least one chronic disease.5 Such diseases require long-term treatment and routine visits for lifestyle management. The growing number of “empty nesters” is a segment of interest as they seek greater independence and invest more in their health than previous generations, resulting in higher “out-of-pocket” expenditure.

However, private sector providers face challenges of their own. Private institutions in Mexico, for example, face a shortage of nurses because they offer lower wages and benefits compared to the pay on offer in the public sector.2

While there is no perfect solution, governments can set the stage for private companies to complement — and in some cases offset — rigid and slow public health systems. Rules and regulations will need to evolve as a result, and already some countries have set up new frameworks to enable greater private participation in healthcare provision. Encouraging local solutions and alternatives to imports is particularly relevant given weakening currencies and grim economic outlook expected until 2018.

In a culture where family bonds play a central role, the home healthcare market presents vast opportunity, particularly as an alternative to building more long-term care facilities. Home care solutions are expected to grow by 8.7% between 2015 and 2020.6

“The rise in the aging population has become the biggest challenge for any economy in Latin America.”

Leading medical device manufacturer

Medical device manufacturers will benefit from supplying equipment for home healthcare solutions, such as ventilators, oximeters, blood pressure and arthritis devices, and glucose monitors. Simplifying products to minimize the learning curve will be critical to gain favor among the elderly, and adapting these products to work in concert with mobile technologies will lead to efficient monitoring. Latin America’s rapid assimilation of mobile technologies has primed the region for its implementation in the healthcare field as an indispensable tool.

Whereas traditional telemedicine initiatives in Latin America focus on connecting hospitals to each other, the combination of mobile technologies with the home healthcare market will allow for involved family members to remain connected with valuable information.

The persistent gathering of patient data and its automated analysis will be advantageous for forming electronic medical record (EMR) systems. Health professionals will possess the ability to better detect at-risk patients and increase lifestyle management, particularly for less- mobile elderly patients.

With the public sector limited by financial constraints, private providers have the opportunity to capitalize on this trend, pioneering the patient-centric movement focused on improving the quality of life for the higher age classes

Source: GHI analysis based on data from www.populationpyramid.net

Source: GHI analysis based on data from www.populationpyramid.net

www.globalhealthintelligence.com 7