Foreword

In a time of economic instability, private and foreign investors have the opportunity to grow their presence in select healthcare markets. The following report delves into three contextual elements to understand healthcare trends in the Latin America, three major burdens countries in the region are all grappling with, and four targeted opportunities for healthcare providers.

Contextual elements

- Currency Devaluations — As shifts in the Chinese economy continue to cause fluctuations in currency markets, all the major main players in Latin America’s healthcare industry have felt the impact of weakening local currencies. Despite dollar-denominated purchases becoming ever more expensive, a lack of local manufacturing leaves many countries with no alternative but to import form abroad. The private sector will have to be cost-efficient to remain flexible and competitive.

- Corruption — Corruption in the healthcare sector has always been a reality, but more so now in troubled economic times. Incidences such as counterfeit products and embezzlement by public figures and private companies adds unnecessary disparities to the healthcare systems of the region. Transparency and accountability are needed to mitigate these practices.

- Pubic-Private Partnerships (PPPs) — with the public sector falling short on infrastructure demands, private enterprises are needed to intervene and complement healthcare service provision, especially in rural areas. Diagnostic imaging and IT health solutions are some of the bright spots, as evidenced by the PPPs that were struck in 2015. Brazil’s change of heart when it opened up its hospitals to foreign investment constitutes one of the biggest opportunities for capital and medical equipment companies.

Major Burdens

- Ageing Population — A growing portion of Latin America’s population is ageing fast as the region reaches the apex of its demographic transition. This has accelerated the increase in healthcare expenditures, while public health institutions are no longer capable of assuming the burden of caring for the elderly. Alternate solutions related to home healthcare may present opportunities for care providers, nursing homes, and medical equipment suppliers providing products that can meet the needs prompted by these demographic changes at a reasonable cost.

- Chronic Diseases — Brought about by the region’s epidemiological transition, non-communicable diseases (NCDs) now account for the majority of deaths in the region. Yet, because of the prevailing biomedical model and a limited focus on primary care, these diseases remain largely unaddressed. Greater emphasis needs to be placed on prevention in order to ease the burden that NCDs place on healthcare systems. Diabetes and cardiovascular diseases are of particular concern, with high prevalence in the majority of Latin American countries. The situation gives medical device and capital equipment manufacturers the opportunity to pioneer the shift towards legitimizing preventative care in the region.

- Obesity — A risk factor for many of the chronic diseases plaguing the region, it is fortunately the one that can most easily be addressed. Consumers can micromanage their health indicators to break free of this pervasive epidemic. Innovative diagnostic and monitoring technology can quantify progress and bring awareness to patients, which can impede the gradual nature of weight gain.

Targeted opportunities

- Obesity — A risk factor for many of the chronic diseases plaguing the region, it is fortunately the one that can most easily be addressed. Consumers can micromanage their health indicators to break free of this pervasive epidemic. Innovative diagnostic and monitoring technology can quantify progress and bring awareness to patients, which can impede the gradual nature of weight gain.

- Technology & Patient-Centric Healthcare — Simplicity and convenience are critical for the swift adoption and dissemination of health technology solutions. The home healthcare and mobile health (mHealth) markets need to embody these principles since many of their services and products require constant use. Segments for these markets include smartphone applications, diagnostic and patient-monitoring equipment. These products and services focus on providing actionable information to patients so that they can achieve their health goals, manage their treatments, and promote prevention. As adoption becomes more widespread, patient-centric healthcare will take root.

- High growth prospects for select medical devices — import data for medical devices and capital equipment throughout Latin America in 2015 reveals certain high-growth niches, including heightened demand for cardiorespiratory equipment.

- Portability and Mobility — Portable X-rays and bracelet-type blood pressure machines hold a significant share within their respective product classes. Trade statistics show that products that enable both simplicity and convenience are in demand, giving an edge to suppliers who can market similar products.

The report’s insights are intended to enable decision makers to seize the right opportunities and inform their go-to-market strategies throughout the region.

To learn more about Global Health Intelligence, our services, consulting engagements and speaking opportunities, please contact:

Guillaume Corpart, Managing Director

gc@globalhealthintelligence.com

+1 (305) 441-9300

www.globalhealthintelligence.com 2

Table of Contents

Foreword…………………………………………………………………………………………………………………………………………………………………………………. 2

Table of Contents………………………………………………………………………………………………………………………………………………………………………3

- Currency depreciation: weakening demand for capital equipment……………………………………………………………………………….4

- Illicit business practices: The burden of corruption on healthcare systems…………………………………………………………………..5

- Budget crunch: government belt-tightening offers opportunities for companies to fill health care gaps……………………………………………………………………………………………………………………………………………………………………………….6

- Ageing Populations: A burden for some, a gold mine for others…………………………………………………………………………………..7

- The silent majority: Targeting the undiagnosed and the unaware will reduce the prevalence of chronic diseases………..8

- The obesity problem: The fat that is hard to shed………………………………………………………………………………………………………….9

- Medical devices: real-time, continuous monitoring is the feature of the future……………………………………………………………..10

- Specialty medical devices: growth rates of over 20% in 2015…………………………………………………………………………………………11

- Capital equipment: Portability and mobility to drive demand………………………………………………………………………………………..12

References…………………………………………………………………………………………………………………………………………………………………………………13

About Global Health Intelligence……………………………………………………………………………………………………………………………………………….15

www.globalhealthintelligence.com 3

1. Currency depreciation: weakening demand for capital equipment

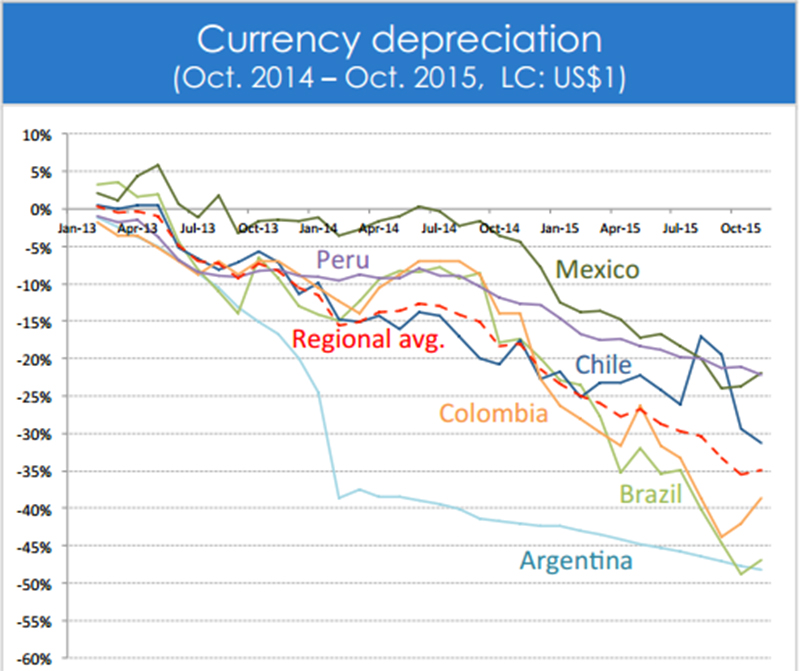

As China shifts its focus towards domestic consumption, it has unfavorably impacted global commodity trading.1 The currency depreciation experienced throughout Latin America reflects falling demand for their export commodities and is putting the region’s long-established dependency on Chinese demand under greater scrutiny (see graph). The region’s economic stagnation is expected to linger through 2018 as regional economies are expect to post only modest GDP growth of less than 3% — well below the robust expansion seen from 2003- 2012.2

Slow growth and weaker currencies leave the region at a disadvantage in regard to dollar-denominated goods. With the majority of medical devices being imported into Latin America, manufacturers and distributors must revisit their pricing regularly in order to ensure they remain both competitive and profitable. Meanwhile, healthcare systems address cost increases through “rearview-mirror” budget planning, making for a challenging balancing act. Industry and government institutions are each defending their respective interests, often resulting in a tug-of-war between public spending and costcutting initiatives, as was the case with Brazil’s healthcare budget throughout 2015.3

Though the economic instability of the region will continue to constrain public health systems, Latin America’s total healthcare expenditure is expected to reach 7.7% of GDP by 2017.4 Future growth will depend on the private sector’s flexibility, and companies’ ability to cater to individuals seeking healthcare outside the scope of the public sector.

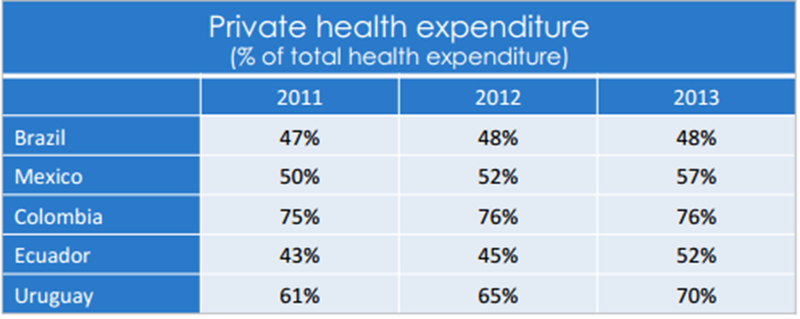

With private expenditure representing 48% and 57% of the Brazilian and Mexican healthcare markets respectively, these are the largest private markets in which to thrive.5-7 Mexico’s rebound since its economic slump in 2011 reflects the vitality of healthcare markets. Mexico’s healthcare spending grew by nearly 10% in 2012, a direct result of the expanding private sector.9 Brazil’s novel policy change in 2015 to open private hospitals to foreign investment also exemplifies the need for expanded healthcare provision and the role of the private sector in meeting this need. Other countries have also seen strong growth within the private sector, notably Chile, Argentina, and Nicaragua.7-9

As the second largest and most dynamic medical device manufacturer in Latin America, Mexico is also showing promise. Thanks to its geographical proximity to the U.S. and its lower manufacturing costs, the country has become the fifth largest exporter of medical devices and remains an enticing choice for mid-sized medical device companies wanting to establish operation in the region.

Source: Global Health Intelligence based on data from xe.com

Source: Global Health Intelligence based on data from xe.com

Opportunities lie in providing cost-effective solutions that help public and private sector healthcare providers keep their costs under control. On the capital equipment side, this may prompt a move towards refurbished or pre-owned equipment backed by a manufacturer warranty; or the extension of maintenance contracts for distributors and integrators. Local manufacturing and contract manufacturing may be an option for certain medical device manufacturers seeking to shift their costs away from the dollar. Increased competition from “budget” solutions will arise, affecting established brands in capital equipment, devices and consumables.

Another promising niche are markets geared towards the elderly and chronic disease management, which have seen growing demand, especially for services and products that cater to the new patient-centric philosophy. Sub-segments include mHealth solutions, telemedicine, and prevention, which aim to both reach more patients and be efficient with resources. Given budgetary pressures, public healthcare institutions will be more deliberate about their spending on healthcare. Certain countries may even need to streamline their healthcare systems, finding efficiencies and new ways to collaborate with the private sector.

www.globalhealthintelligence.com 4

2. Illicit business practices: The burden of corruption on healthcare systems

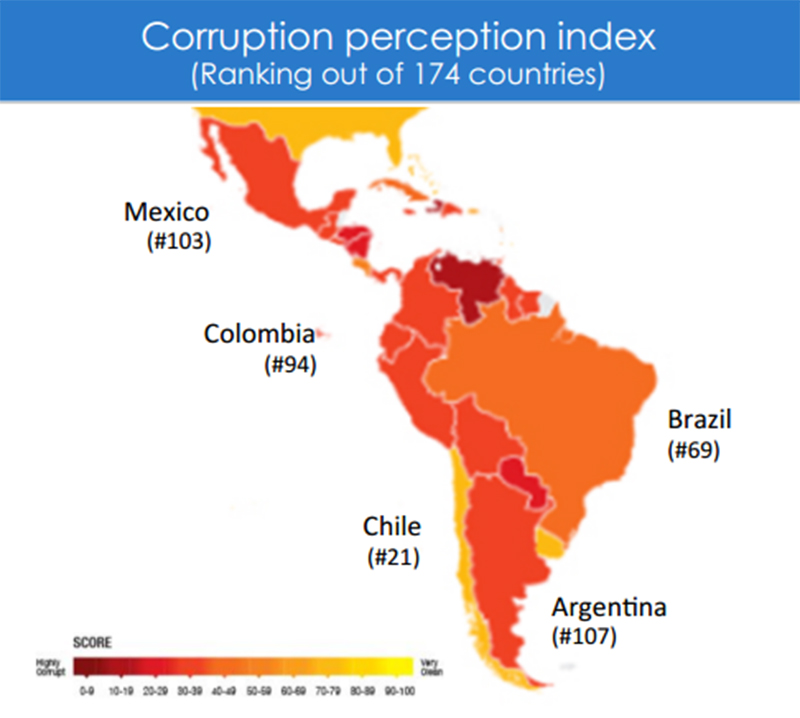

Unethical business practices have a heavy influence on the healthcare systems of Latin America. Theft, bribery and extortion have led to monetary losses in the billions. According to Transparency International’s 2014 Corruption Perception Index, the extent of the damage is severe enough to classify two-thirds of the region’s 31 countries alongside the world’s most corrupt nations.1 And yet the region can ill afford anything that would further constrain its healthcare system by limiting available resources, lowering the effectiveness and efficiency of services, or lowering quality of overall care. Even though engaging in corruption presents significant risks to companies – with the risk of a tarnished reputation and billion-dollar corporate fines among the most severe, unethical behavior will continue to play a role in Latin America.

“I have yet to hear of one country in Latin America that does not have an issue with the role of corruption.”

Leading medical device manufacturer

Much of the corruption stems from political figures and unethical behavior in the public sector. The prevalence of state-owned or state-controlled healthcare institutions have led to compliance challenges regarding anti-bribery laws.

- In Mexico, kickbacks on government contracts can reach 25% to 30% of project value in the form of cash and other material goods such as computers, cars, land, constructions, homes and political favors.

- In Honduras, the vice-president of Congress, Lena Gutierrez, and some of her family have been charged with fraud, crimes against public health and falsification of documents. They are suspected of having links to a company that allegedly embezzled the state by selling poor-quality medicine at inflated prices.2

- In Guatemala, political corruption in the health system has directly led to loss of lives. Authorities arrested 17 people, including the head of the Guatemalan Central bank, in an ongoing investigation into fraud at the Instituto Guatemalteco de Seguridad Social (IGSS). The scandal reveals that IGSS employees and the head of the Bank of Guatemala stood to make 15% in kickbacks. These persons have been charged with fraud, bribery, conspiracy, influence peddling, illegal collection of fees, illicit association and insider trading. Charges of culpable homicide could be filed as the scandal resulted in the deaths of at least five kidney-failure patients.3

Corruption goes beyond bribes and kickbacks. There are cases of individuals and entities often billing the government for services that were never rendered or even selling expired medications in altered packages.4 In Ecuador, such behavior has become a major issue for the healthcare system. Guayaquil’s Teodoro Maldonado Carbo Hospital

Source: Transparency International

Source: Transparency International

has been one such source of corruption where dozens of tunnels have been used to smuggle medicines out of the hospital for illicit sale.5

Even Brazil’s image has been stained by corruption as the Petrobras scandal comes to light, involving both public and private individuals in a multi-million dollar affair that appears to lead as high as the Presidential Office.

Impunity at the top enables corruption to flourish. As new leaders take office, they have an opportunity to change long-established practices. They must look towards anti-corruption initiatives to reduce the impact of unethical behavior in the region. The priority for improving healthcare management systems is to increase transparency. There is an opportunity for international agencies and civil society to come together in the fight against these unethical practices.

- One such example is The World Bank, which assists countries in appointing high profile committees to investigate the scale and scope of corruption in their societies, to set priorities for anti-corruption activities, and to develop and implement action plans.3 These action plans are only effective when they receive high-level political assistance and involve the public and media by opening channels for participation.

- Organizations such as Transparency International can empower citizens to take action and hold politicians accountable for unethical government acts. Activities such as holding regional workshops have helped equip concerned citizens with new ways to combat corruption such as survey instruments and citizen initiatives.3

Transparency and accountability must increase if the role of corruption is to diminish.

www.globalhealthintelligence.com 5

3. Budget crunch: government belt-tightening offers opportunities for companies to fill health care gaps

As they strive to provide healthcare to large populations characterized by vast income disparities, Latin American governments struggle with the tradeoffs between accessibility and quality of care. Brazil, for instance, possesses some of the region’s most renowned healthcare institutions, but the majority of the country’s public healthcare system suffers from poor planning and understaffing. With few exceptions, most Brazilians complain of long wait times in the public system.1

Mexico also faces challenges with a lack of public-private partnerships and poor distribution of resources — public institutions often overlap by geography and unnecessarily duplicate services; they also have yet to reach a consensus on patient portability.2 These legacy systems fall well short of addressing the growing healthcare pressures of an ageing population.

The lack of infrastructure and misallocation of resources nevertheless offers opportunities for the private sector, especially in countries such as Brazil, Mexico, Chile, and Colombia, where healthcare expenditures are rising. Companies who can offer high-quality care and treatment at a reasonable cost stand to make significant gains.3

Source: The World Bank

Source: The World Bank

However, private sector providers face challenges of their own. Private institutions in Mexico, for example, face a shortage of nurses because they offer lower wages and benefits compared to the pay on offer in the public sector.2

While there is no perfect solution, governments can set the stage for private companies to complement — and in some cases offset — rigid and slow public health systems. Rules and regulations will need to evolve as a result, and already some countries have set up new frameworks to enable greater private participation in healthcare provision. Encouraging local solutions and alternatives to imports is particularly relevant given weakening currencies and grim economic outlook expected until 2018.

- Leading this trend is Brazil, where in early 2015 President Roussef announced that foreign companies could invest in private hospitals, thus helping to expand private care and shifting part of the financial burden away from the public sector. Private equity funds Carlyle Group and GIC Holdings invested over $600 million in the Rede D’Or São Luiz hospital chain, to construct new hospitals and expand current facilities.4

- IFC recently helped expand Brazil’s outpatient service centers for its third largest diagnostic imaging company, and has also provided telemedicine services to Colombians in remote areas.5

- Management Sciences for Health (MSH) received funding to provide technical assistance to Mexico, Nicaragua, Honduras, and other countries throughout the region to increase access to integrated health services.6

- Telemedicine gained traction in Argentina throughout 2015. Through the recently launched National CyberHealth Plan, Argentina is developing a connected network of hospitals. The country is taking advantage of this new infrastructure to pioneer new technologies such as tele-ultrasounds and tele-resonance scans. Private companies like Philips are investing in this field by expanding the number of Picture Archiving and Communication Systems (PACS), a remote-radiology service, in Brazil and introducing them into Argentina. 7-8

“…Private companies and entrepreneurs will take over a lot of government functions, sparking huge opportunities to profit from a vast population that won’t mind paying to get the service they deserve — mostly in health care…”

Luis Arnal, President and Founder of INSITUM

These initiatives, though principally driven by cost-efficiency concerns, also reveal a desire to transition toward (1) a cloud-based framework and (2) patient-centric healthcare. Suppliers involved with connectivity, health IT, and diagnostic imaging will be able to capitalize on regional trends to expand in these fields. Private institutions, in turn, are expected to step in and complement the public sector’s shortcomings with offerings geared to the “middle market consumers” – products and services geared to those who want access to better healthcare at reasonable cost.

www.globalhealthintelligence.com 6

4. Ageing Populations: A burden for some, a gold mine for others

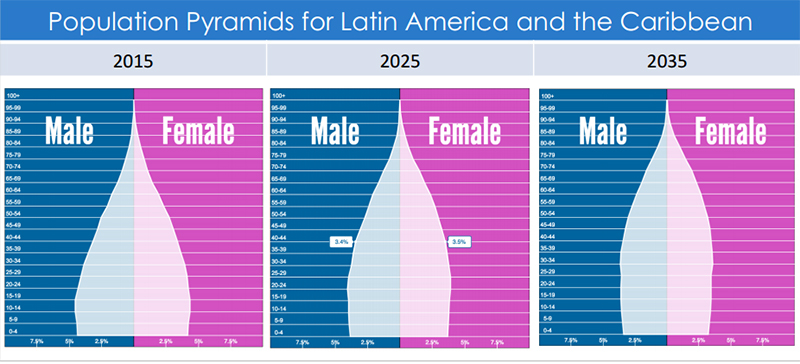

Latin America is experiencing steady and significant ageing of its population – largely driven by the expansion and modernization of healthcare provision and the ensuing rise in life expectancy. The confluence of continued technological progress and dropping fertility rates has led to growing concerns about the sustainability of all publicly financed social welfare programs, particularly healthcare.

Latin America’s geriatric base is a pressing issue for healthcare systems, both public and private. In 2010, 10% of the region’s population was over 60 years old. By 2040, this number is expected to more than double, reaching 21%.1 The phenomenon is not unique to Latin America – other countries dealing with similar issues include the United States (where projections indicate that 22% of the population will be over 60 by 2040) and Japan (where 25% of the population is currently over 60 years old).2,3 The burden of ageing demographics has led the Japanese healthcare system into a crisis, which serves as a cautionary tale to even the best managed health care systems elsewhere.

As the number of working-age adults decreases as a proportion of the total population, the ageing of the population will result in a net economic burden, particularly when considering that seniors account for a disproportionate amount of healthcare costs. These costs will be partially responsible for Latin America’s expected rise in healthcare expenditures, increasing an average of 4.6% per year through 2018.4

Chronic diseases are the principal cost driver associated with ageing population, as over 80% of adults over 60 have at least one chronic disease.5 Such diseases require long-term treatment and routine visits for lifestyle management. The growing number of “empty nesters” is a segment of interest as they seek greater independence and invest more in their health than previous generations, resulting in higher “out-of-pocket” expenditure.

However, private sector providers face challenges of their own. Private institutions in Mexico, for example, face a shortage of nurses because they offer lower wages and benefits compared to the pay on offer in the public sector.2

While there is no perfect solution, governments can set the stage for private companies to complement — and in some cases offset — rigid and slow public health systems. Rules and regulations will need to evolve as a result, and already some countries have set up new frameworks to enable greater private participation in healthcare provision. Encouraging local solutions and alternatives to imports is particularly relevant given weakening currencies and grim economic outlook expected until 2018.

In a culture where family bonds play a central role, the home healthcare market presents vast opportunity, particularly as an alternative to building more long-term care facilities. Home care solutions are expected to grow by 8.7% between 2015 and 2020.6

“The rise in the aging population has become the biggest challenge for any economy in Latin America.”

Leading medical device manufacturer

Medical device manufacturers will benefit from supplying equipment for home healthcare solutions, such as ventilators, oximeters, blood pressure and arthritis devices, and glucose monitors. Simplifying products to minimize the learning curve will be critical to gain favor among the elderly, and adapting these products to work in concert with mobile technologies will lead to efficient monitoring. Latin America’s rapid assimilation of mobile technologies has primed the region for its implementation in the healthcare field as an indispensable tool.

Whereas traditional telemedicine initiatives in Latin America focus on connecting hospitals to each other, the combination of mobile technologies with the home healthcare market will allow for involved family members to remain connected with valuable information.

The persistent gathering of patient data and its automated analysis will be advantageous for forming electronic medical record (EMR) systems. Health professionals will possess the ability to better detect at-risk patients and increase lifestyle management, particularly for less- mobile elderly patients.

With the public sector limited by financial constraints, private providers have the opportunity to capitalize on this trend, pioneering the patient-centric movement focused on improving the quality of life for the higher age classes

Source: GHI analysis based on data from www.populationpyramid.net

Source: GHI analysis based on data from www.populationpyramid.net

www.globalhealthintelligence.com 7

5. The silent majority: Targeting the undiagnosed and the unaware will reduce the prevalence of chronic diseases

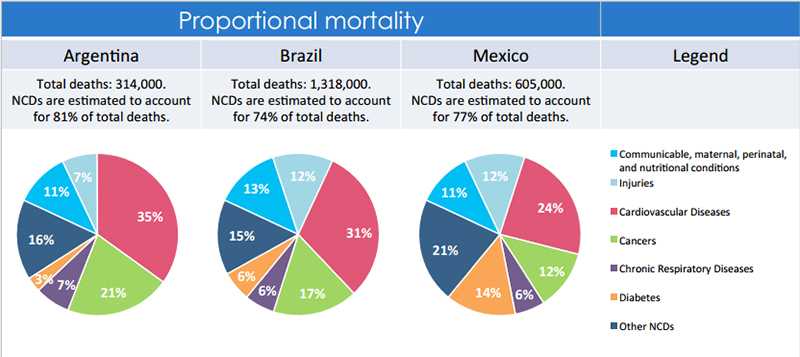

Infectious diseases in Latin America are quickly becoming a thing of the past. The most resilient diseases, such as AIDS, tuberculosis, and malaria account for less than 10% of deaths in the region.1 Chronic diseases, on the other hand, are the principal causes of death for countries in the advanced stages of their epidemiological transition, such as Chile, Argentina, Mexico, Brazil and Uruguay.1 Other countries in the region are expected to follow suit, thus elevating the burden region-wide.2-3

These non-communicable diseases (NCDs) place a large strain on healthcare resources due to the regular and sophisticated treatments they require. This is particularly true when considering higher age groups and the health complications that ensue. With a growing geriatric base, these factors compound each other, further emphasizing the challenged associated with chronic diseases.

Given the nature of chronic diseases, patients will continue to seek treatment involving long-term care. Yet the levels of dissatisfaction with public health systems is such that many seek out the services they need privately with out-of-pocket expenditures. Private care providers and equipment suppliers can capitalize on this trend to strengthen their presence in key markets.

Prevention and awareness are the main strategies to combat chronic diseases, and, indeed, public healthcare systems have been seeking focusing on such activities to maximize returns on taxpayer-funded expenditures. Outreach programs in the form of social events and international collaborative efforts have been successful. The 2014 World Diabetes Day in Mexico City is an exemplary model for the kind of prevention the region needs. Involving more than 15,000 people, the International Diabetes Foundation (IDF) aimed to educate the local population about lifestyle choices and also provided services such as simplified blood sugar testing, healthy cooking workshops, and exercise classes.4 The region is ripe for similar awareness-raising events, such as “World Hypertension Day”.

Awareness programs remain as a cost-effective way to gain traction with at-risk populations and avoid the sophisticated treatment of chronic disease management. The key to their success is empowering local communities and ensuring proper outreach to unaware populations by focusing the event on crowd-pleasing activities with tangible health benefits. Properly designed efforts can potentially unearth the large number of undiagnosed or uneducated patients, and significantly prevent costly health expenditures. According to the Diabetes Atlas, estimates show that of the 392 million patients with diabetes in the world, 46% are undiagnosed.5 The Prospective Urban

and Rural Epidemiology (PURE) study released late 2014 also revealed low awareness rates for hypertension throughout Latin America. At the forefront of this trend are Argentina, Brazil, Mexico, and Chile, where only 57% of people with hypertension are aware of their condition .6 Unsurprisingly, cardiovascular, respiratory diseases, cancers and diabetes rank as the main causes of death in these countries.

“The rapid progressive illnesses and deaths of yesteryear (infectious diseases and, more recently, cancers) have been replaced by vastly increased survival rate from such illnesses and a pandemic-like shift from acute to chronic illness, with long years of survival that are often accompanied by a reduced quality of life requiring more and longer home care.”

Grace Christ and Sadhna Dawan from Council on Social Work Education

Yet the disease profiles for Latin American countries also provide a welcome focus for designing high-impact awareness and prevention programs. Health-coaching applications and wearable technologies can work in concert with prevention and are expected to continue expanding throughout 2025.7 Surveys indicate consumers are ready to lead healthier lifestyles and will use wearable technologies as a way to exercise smarter, eat healthier, and track their medical history.8 As Latin American consumers continue to drive mobile adoption, the face of awareness campaigns may well take on a technological component. For example, the Pan American Health Organization (PAHO) created smartphone apps and online courses to deliver practical information used in the management of population health. Such technological progress will make outreach programs more effective than ever.

Awareness is the cornerstone of prevention. But more importantly, at-risk patients are empowered through understanding. Prevention-related activities will help counter the onset of chronic diseases through the power of information, thus promoting early detection and improving quality of life. Such activities also relieve some of the expenditure from acute symptoms such as strokes and myocardial infarctions.

www.globalhealthintelligence.com 8

6. The obesity problem: The fat that is hard to shed

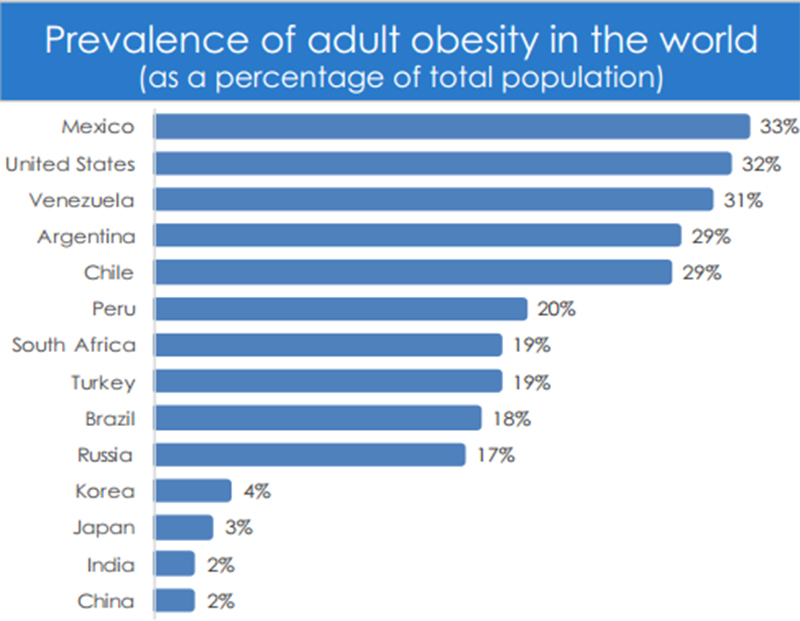

Now recognized as a worldwide epidemic, obesity is responsible for negative effects not just health-wise but also from a cultural and social standpoint – and Latin America is no exception. Obesity is the fastest rising non-communicable disease (NCD) in the world, and now afflicts over 56% of adults in Latin America — well above the global average of 34%.1 As a leading indicator of future health problems, the spread of obesity cannot go unmanaged. Populations stand to gain long-term health benefits that protect them against the burden of chronic diseases.

Eating habits, globalization, stress, and sedentary lifestyles are the root causes for the prevalence of obesity in Latin America. Drastic dietary changes are the most obvious sign of the epidemic across the region. Following in the footsteps of North American eating habits, the sale of ultra-processed foods grew by 48% between 2000 and 2013.2 Sedentary lifestyles are due to the growing work constraints and busy schedules associated with urbanization, as well as the lack of space for physical activity. The double burden of malnutrition creates the unique situation where nutritional deficiency exists alongside obesity. Food insecurities and low incomes propel this double burden, such as in Mexico and Argentina.3

Latin America is home to some of the highest obesity rates in the world. Mexico, most famously, surpassed the U.S. in 2013 as the world’s most obese country. It is expected that Mexico will continue to see a steady rise in its obese population given the high proportion of its population considered overweight. In 2015, over 70% of Mexico’s overall population and 57% of children were considered overweight.4 Other Latin American countries such as Venezuela, Argentina and Chile possess similar rates.5 This places an enormous burden on the healthcare sector, as obesity is a precursor to more severe health issues.

“Obesity is a huge problem, but people don’t die from obesity. People die from health problems related to obesity.”

Leading medical device manufacturer

The same high-fat and sodium diets that lead to higher body mass indices also cause plaque buildup, hypertension, inefficient insulin uptake, and musculoskeletal conditions.6 Though one of the easier risk factors to manage, the conditions arising as a result of obesity place a huge strain on Latin America’s healthcare systems, most notably in the form of cardiovascular diseases and diabetes.

Products that can monitor, record and display health statistics such as blood pressure, glucose levels, calories, and weight can influence behavior and reverse the effect of harmful non-

Source: GHI Analysis based WHO Infobase, OECD Health 2014, and foreignpolicy.com

Source: GHI Analysis based WHO Infobase, OECD Health 2014, and foreignpolicy.com

communicable diseases before complications arise. These products can promote prevention through awareness by demonstrating the gradual consequences of harmful diets, which otherwise go unnoticed. With healthcare mobility solutions expected to grow by 25-30% annually through 2020, suppliers stand to benefit from introducing products such as wearables and smartphone applications, among others.7

The demand for these medical devices and other products in this niche are part of a much larger trend toward patient-centric healthcare.6 By empowering individuals to hold themselves accountable for managing their personal health, there is potential for much greater knowledge dissemination (e.g., nutrition education) as well as effective incentives for behavior change (e.g., weight loss). Products that enable individuals to micromanage their own health indicators (e.g., achieving a target heart rate) make it easier to detect progress — and relapses. The greater prize of these mobile solutions is the patient adherence and the vast amounts of data resulting from constant communication between healthcare providers and patients.

Effective health management across large populations is not far off. There are opportunities for both public and private institutions to collaborate in this space, whether via awareness campaigns, wearable devices, integration of electronic medical records (EMR) or other solutions.

Addressing the overweight and obese populations of Latin America goes hand in hand with efforts to prevent chronic diseases. For instance, having a family reorganize their budget for food purchases and make the time for physical activity is less costly than the medication required for treating a chronic disease or the emergency care that sometimes results from it. This sort of preventative care against obesity could ease the burden on Latin America’s healthcare systems.

www.globalhealthintelligence.com 9

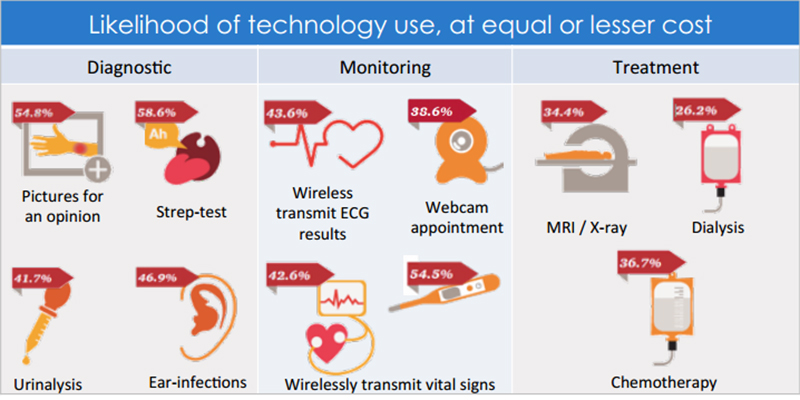

7. Medical devices: real-time, continuous monitoring is the feature of the future

Technology penetration in Latin America has progressed at break-neck speed. Internet and smartphone usage rates are now on par with North America, Europe, and Southeast Asia. Already home to over 155 million smartphone users in 2015, the region is expected to maintain growth rates of over 20% per year in the near future. By 2019, it is estimated that 42% of the population will possess a smartphone device, and the majority will have Internet access.1-3

Successful technologies will soon permeate daily life to promote simplicity and convenience. These benefits of technology are desperately needed in the healthcare sector, where the ageing population, rise in obesity, and increase in chronic diseases have accelerated demand for expensive, sophisticated and long-term treatments.4 The need is all the more acute as public health sector resources are severely strained.

Two target demographics stand out for the adoption of effective healthcare technologies: the “technology converts” and the “digital natives,” who between them are forecasted to represent 75% of Latin America’s population by 2020.

As the population ages, more people are subject to the chronic diseases, such as cancers and arthritis, where complications can arise and require multidisciplinary care.5-7 These are usually taxing on the healthcare systems, and the patients themselves. Ageing persons will benefit from diagnostic and monitoring equipment promoting remote (or home) healthcare, which will allow for the management of chronic diseases at a distance. The home healthcare market is expected to grow by 8.6% annually and will reach a value of $17.5 billion by 2020.8 The services and products within the market (e.g., blood pressure and blood glucose monitors, hospice care, therapy) will bring services usually administered at a doctor’s office to patients directly, therefore increasing convenience for all parties. Anybody interested in maintaining a closer watch on their health in order to facilitate prevention and promote early detection will have the means and the tools to do so.

Countries with concentrated use of mobile technologies are the most attractive target markets. Argentina, Brazil, Chile, Colombia, Mexico, and Peru account for approximately 84% of all smartphone users region-wide,1 making them ripe for adoption of mHealth software solutions.

- Wearable devices (“wearables”) such as fit-bands, smart watches and augmented reality glasses are “gadgety” elements that will help bring population health management to the everyday lives of consumers. Surveys show a preference for using these devices to improve health by eating and exercising more smartly, and tracking medical information.9

Though market studies suggest Latin America is not yet ready for wearable devices, the region is forecasted to follow in the footsteps of more developed market, with alluring growth prospects of up to 41% annually through 2018.10

“Consumers are embracing their “quantified selves”, using sensors, software, and devices to measure multiple aspects of their health and well-being.”

PwC Customer Experience in the Pharmaceutical Sector

- mHealth apps – healthcare and medical smartphone applications for patients and healthcare professionals are the most promising markets in Latin America. Applications dealing with diabetes management and blood pressure & ECG management are expected to be the fastest growing sub-segments. The global mHealth solutions market is expected to reach $59 billion by 2020, growing 33% annually, and Brazil and Mexico are expected to offer the largest opportunities region-wide.11

- Wirelessly connected devices such as blood pressure cuffs and infusion pumps are the next frontier. Their attractiveness is their ability to effortlessly collect data, present it to patients and transmit it to physicians. Automation and ease of use are key attributes in such devices, which are mainly designed for the elderly and people with diabetes.

Each of these markets will promote the adoption of a more holistic approach to healthcare, which will eventually lead to an industry-wide shift away from routine medical checkups to data-driven, “as needed” appointments. People will be able to monitor their health automatically and manage their data and health-related decisions whenever they want. This represents a genuine paradigm shift in healthcare, which will pave the way towards leaner, connected and personalized health systems.

Source: GHI Analysis based on HRI/CIS Wearables Consumer Survey (2013),USA.

Source: GHI Analysis based on HRI/CIS Wearables Consumer Survey (2013),USA.

www.globalhealthintelligence.com 10

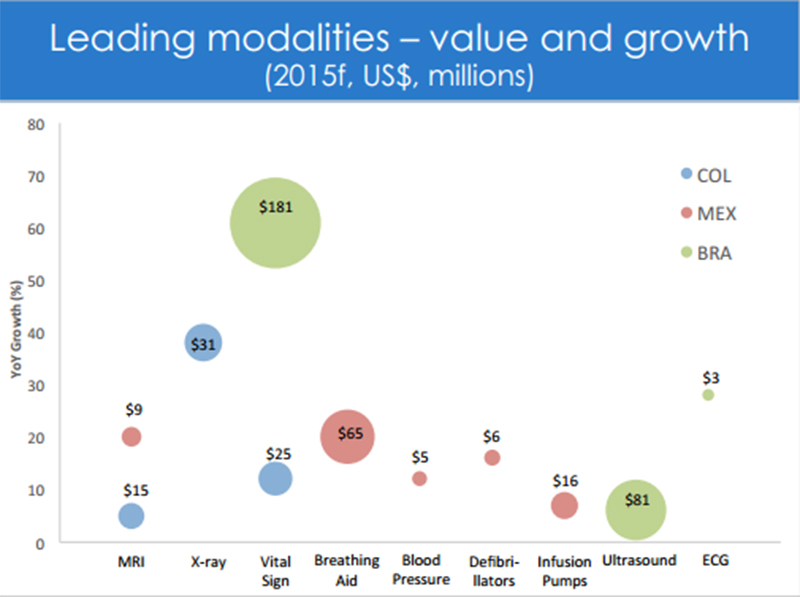

8. Specialty medical devices: growth rates of over 20% in 2015

Examining medical device import trends offers intimate insight regarding the pressures and demands affecting the industry. This analysis reveals opportunities for global players and regional leaders alike.

In 2015, imports of capital equipment for the medical field contracted slightly from $5.2 billion to $5.1 billion year-over-year (YoY). Despite stagnant numbers, there are still a number of profitable product classes in response to the region’s epidemiological transition, where ageing populations and a pervasive obesity epidemic have left countries facing a high prevalence of non-communicable diseases (NCDs). Deaths stemming from chronic diseases are projected to reach 84% by 2030, this is—and will continue to be—the primary driver for capital equipment imports in coming years.2

Mexico, Brazil, Argentina and Colombia account for over 80% of the region’s import and sales of capital equipment. All of these countries have made efforts to revitalize their healthcare systems that present opportunities for manufacturers, distributors and integrators alike.

In spite of the worsening economic downturn, the Brazilian government allocated funds towards teaching hospitals and improving specialty services in 2015; Mexico has initiated plans to streamline their medical imports as well as proposed initiatives to migrate systems to electronic medical records (EMRs); and Argentina has initiated their National CyberHealth Plan to expand patient outreach.

Manufacturers, distributors and integrators can expect sustained interest in capital goods, led by diagnostic and patient monitoring equipment. Given the continued need for capital equipment as well as the financial constraints of payers, second-generation and certified refurbished equipment may gain traction.

In Mexico, infusion pumps rank as the dominant product class for the country’s imports, displaying a 7% YoY increase. Breath-enhancing machines (such as ventilators and nebulizers) as well as defibrillators experienced the highest growth, with a 20% YoY increase (to reach a market value of $98 million), and a 23% YoY increase (to reach a market value of $9.4 million), respectively. Other product classes showing significant growth are blood pressure monitors, with a 2% YoY increase to reach a market value of $11.6 million. Such gains are not exclusive to Mexico. Brazil’s highest-growth product class, electrocardiograph machines, increased 28% to reach $4.0 million. The country also saw growth of 6% in ultrasound machines, reaching a market value of $107 million. Meanwhile, Colombia displayed a 5% YoY growth in MRI machines, reaching $15 million by year-end 2015.

Suppliers should heed the cardiorespiratory-centric nature of Latin America’s imported capital equipment; such focus is not

Source: Global Health Intelligence, 2015

Source: Global Health Intelligence, 2015

coincidental. Currently, Mexico, Venezuela and Argentina are among the most obese countries in the world; bleak overweight rates in Brazil, Colombia, and other countries foreshadow the same trend elsewhere in the region. 3-6 Simultaneously, the potentially fatal conditions that go hand in hand with the obesity epidemic and an ageing population (e.g., diabetes, cardiovascular diseases, blood vessel blockage) are expected to continue rising.4,8,9 Hence the significant potential for the diagnostic and treatment capabilities of infusion pumps, defibrillators, MRIs, electrocardiographs, blood pressure monitors, and ultrasound machines, which address the acute and chronic symptoms of these diseases and their associated risk factors. Suppliers should expect resilient growth in products aimed towards insulin management, hypertension, atherosclerosis, embolism/thrombus formation, and decreased pulmonary function.

Given gradual ageing of the population, the spread of chronic diseases, and forecasts indicating region-wide growth in healthcare spending of 4.8% per year through 2018, the demand for these product classes will persist in the near future.9 Additional opportunities exist in aligning portable patient monitoring devices with government awareness and education campaigns. Existing government programs could use these devices to further public health objectives. Such is the case of Mexico’s National Strategy for Prevention for Control of Overweight, Obesity and Diabetes and Brazil’s School Education Program, which also encourage awareness and lifestyle changes.10

There is a clear regional trend to embrace products made “simple and convenient”, with portability features and home use in mind, particularly if these are able to strengthen the patient-doctor relationship.

www.globalhealthintelligence.com 11

9. Capital equipment: Portability and mobility to drive demand

As urbanization and medical technology advancements extend life expectancy and decrease the need for acute care, long-term strategies and solutions are required. Equipment and device manufacturers will witness greater growth from products that privilege mobility, portability and care outside of traditional healthcare facilities.

Despite the current unfavorable economic climate, high growth is anticipated in diagnostic and patient monitoring equipment. Latin American countries are expected to lead global growth of X-ray devices through 2019.1 Additionally, the capnography equipment market is expected to grow at by 15% annually through 2021, with Brazil, Mexico, Colombia and Argentina at the forefront.2 Growth is also expected in products related to blood-glucose monitoring and insulin delivery, with growth estimated of 6.3% per year to reach $2.3 billion by 2020, led by Brazil and Mexico. Growth in these areas is a direct response to the region’s epidemiological transition: the rise in respiratory diseases, diabetes, and cardiovascular disorders requires the necessary equipment to manage and monitor symptoms.

Of particular interest among certain medical devices is the growing share of products that emphasize digitized automation and/or portability. For instance, the analysis of medical equipment imports reveals that portable X-ray machines represent nearly 20% of all the X-ray machines coming into the Mexico in 2015, a market segment expected to grow by 7.6% per year through 2020.3 Similarly, there is a growing preference for electronic blood pressure devices, as manual sphygmomanometers are steadily being phased out by versions that require less human intervention. Simplicity and convenience are the main drivers, with bracelet-type blood pressure devices growing their presence, enabling patients to read their blood pressure at the click of a button.

Portable and mobile products focused on the monitoring and prevention of chronic diseases, with easy-to-use features, will have a strong competitive advantage across Latin America. This can be achieved through two families of products: wearable devices (wearables) and home care equipment.

The traction wearables are gaining in Brazil and Mexico foreshadows opportunities in the region to come. Brazil is the

4th largest smartphone market in the world, and 46% of its populations is aware of wearables. Samsung has already established the strongest presence of wearables throughout the region.4,5 Similarly, Mexico’s wearable sensor market is expected to increase by 40.61% annually from 2014-2020.6

The region’s adoption of smartphone technology and applications has allowed care providers to take advantage of customer’s willingness to reinforce patient-centric healthcare. This has created an untapped market for products that monitor patients’ signs and collect information to be analyzed and used towards early detection and treatment. Products likeliest to thrive are those that help detect early onset of chronic diseases such as diabetes and cardiovascular issues.

Though home care devices are currently in a nascent stage, emerging economies will soon begin to see its potential; the market is expected to grow at over 8% per year through 2020.7 Portability and mobility will legitimize products for at-home services, such as mobile X-ray facilities (already in existence in North America and Europe), and will also give patients more tolls and options to manage their own health.

Recent efforts by governments to modernize and wirelessly connect their healthcare sectors give suppliers the ability to extend the functionality of their products by providing telehealth-like communication between doctor and patient. Patients could use smartphone applications and wearables to manually enter data their physicians can access; the devices themselves could automatically transmit the data. Such products intended for at-home usage reduce patient visits and the waste of time on the part of both patients and healthcare institutions. By bringing healthcare services and solutions to the patient, inclusivity is maximized and patient monitoring is kept consistent, considerably reducing the degree of costly professional intervention.

In the near future, global markets for mobile healthcare solutions and wearables are expected to grow at 25%-30% CAGR during 2015-2020. Though its adoption in Latin America may be slow due to the high cost of devices and the lack of awareness, suppliers can jumpstart this growth.

www.globalhealthintelligence.com 12

References

1. Currency depreciation: weakening demand for capital equipment

1 AMI analysis based on: Meyer, David. “Latin American Currencies Sink on Yuan Devaluation Woes.” Market Realist, August 2015.

2 AMI analysis based on: “Latin America and the Caribbean: Overview.” World Bank, 2015.

3 GHI analysis based on: “Veja as 9 medidas de corte de gastos anunciadas pelo governo.” Globo, 2015.

4 AMI analysis based on: “Latin America: Healthcare Outlook.” The Economist Unit Intelligence Report, 2015.

5 AMI analysis based on: Meyer, David. “Latin American Currencies Sink on Yuan Devaluation Woes.” Market Realist, August 2015.

6 AMI analysis based on: “Latin America and the Caribbean: Overview.” World Bank, 2015.

7 World Bank database based on: World Health Organization, Private Health Expenditure (% of GDP). World Bank, 2014.

8 GHI Analysis based on: “OECD Health Statistics 2014: How does Mexico compare?” OECD, 2015.

9 AMI analysis based on: “Latin America: Healthcare Outlook.” The Economist Unit Intelligence Report, 2015.

2. Illicit business practices: The burden of corruption on healthcare systems

1 Data Team. “A less crooked continent?” The Economist, March 2015.

2 “Honduras Corruption Probe Widens as Lawmaker is Held.” BBC, July 2015.

3 Wirtz, Nic. “Corruption Network in Guatemalan Health System Exposed.” Quarterly Americas, May 2015.

4 Savedoff, William D. “Transparency and Corruption in the Health Sector: A Conceptual Framework and Ideas for Action in Latin America and the Carribean.” Inter-American Development Bank, May 2007.

5 Morla, Rebeca. “ Ecuador’s Hospital ‘Mafia’ Unearthed in Guayaquil.”Panam Post, March 2015.

3. Budget crunch: government belt-tightening offers opportunities for companies to fill health care gaps

1 “Perspectives on Healthcare in Latin America.” McKinsey and Company. 2011.

2 “Medellín Has 8 of the Best Hospitals in Latin America.” First American Realty Medellin. 13 Jan 2015.

3 “Global Healthcare Outlook: Shared Challenges, Shared Opportunities.” Deloitte. 2014.

4 GHI Analysis based on: Sreeharsha, Vinod. “Carlyle Takes Stake in Brazilian Hospital Operator.” New York Times. 28 April 2015.

5 “IFC Issue Brief: IFC and Private Sector Health Care – Noteworthy Investments.” International Finance Corporation (World Bank Group). April 2015.

6 “MSH Receives Public-Private Funding to Strengthen Health Service Delivery in Latin America.” Management Sciences for Health. 8 October 2015.

7 “What are the Five Key Strategic Pillars to the National CyberHealth Plan?” E-Health Reporter. 20 August 2015.

8 “The First Tele-magnetic resonance scan performed as part of the CyberHealth Plan.” E-Health Reporter. 18 September 2015.

4. Ageing Populations: A burden for some, a gold mine for others

1 AMI analysis based on: Heunchuan, Sandra. “Ageing, solidarity, and social protection in Latin America and the Caribbean.” Economic Commission for Latin America and the Caribbean (ECLAC). February 2013.

2 Administration on Aging. “Aging Statistics.” U.S. Department of Health and Services, 2014.

3 Hongo, Jun. “Fear of Dying Alone: The State of Japan’s Aging Population.” The Wall Street Journal (Japan), June 2015.

4 “2015 Global Healthcare Outlook: Common Goals, Competing Priorities.” Deloitte. 2015.

5 “Healthy Aging: Chronic Disease Management.” National Council on Aging. 2015.

6 “Rising Prevalence of Chronic Diseases Propels Latin America Home Healthcare Market to US$17.5 bn by 2020.” Transparency Market Research. 12 October 2015.

5. The silent majority: Targeting the undiagnosed and the unaware will reduce the prevalence of chronic diseases

1 Glassman, Amanda et al. “Confronting The Chronic Disease Burden in Latin America and the Caribbean.” Health Affairs 29:12, December 2010.

2 AMI analysis based on: Heunchuan, Sandra. “Ageing, solidarity, and social protection in Latin America and the Caribbean.”Economic Commission for Latin America and the Caribbean (ECLAC), February 2013.

3 Pilania, Manju. “Epidemiological Transition.” LinkedIn SlideShare, 2015.

4 “Be a Part of the Wdd 2015 Campaign.” International Diabetes Federation, 2015.

5 Barcelo A., Gordillo A., Quian A. “The Cost of Diabetes in Latin America & the Caribbean in 2014.” Pan American Health Organization, World Health Organization, 2014.

6 “PAHO/WHO Urges More Attention to Blood Pressure Control.” Pan-American Health Organization, May 2015.

7 “Latin America Wearable Sensors Market – Growth, Trends and Forecasts (2015-2020). Mordor Intelligence, August 2015.

8 GHI Analysis based on: “Health Wearables: Early Days.” PricewaterhouseCoopers, 2014.

www.globalhealthintelligence.com 13

6. The obesity problem: The fat that is hard to shed

1 Moloney, Anatasia. “Obesity Weighs on Latin America After Success in Fight Against Hunger.” Reuters Health, February 2015.

2 ”Ultra-processed Foods are Driving the Obesity Epidemic in Latin America, Says New PAHO/WAHO Report.” WHO/PAHO. 1 September 2015.

3 Hyman, Mark. “How Malnutrition Causes Obesity.”Solstice Publications: Food and Health.

“The Double Burden of Undernutrition and Obesity in Latin America: Where Do We Stand and Where Do We Go?” Sight and Life. January 2015.

“The Double Burden of Malnutrition: Case Studies from Six Developing Countries.” Food and Agricultural Organization of the United Nations. 2006.

4 ”Obesity and the Economic of Prevention: Fit not Fat. Key Facts: Mexico, Update 2014.” OECD.

5 Bodzin, Steven, and Sarah Miller Llana. “Obesity Weighing on America – Latin America, That Is.” Christian Science Monitor. 4 September 2012.

6 “Health Risks: Weight Problems Take a Heft Toll on Body and Mind.” Harvard T.H. Chan School of Public Health.2015.

6 “Rising Prevalence of Chronic Diseases Propels Latin America Home Healthcare Market to US$17.5 bn by 2020.” Transparency Market Research. 12 October 2015.

7 GHI Analysis based on: “Healthcare Mobility Solutions Market by Products & Services, Application, End User – Global Forecast to 2020.” PR Newswire, November 2015.

7. Medical devices: real-time, continuous monitoring is the feature of the future

1 “Latin America Home to 155.9 Million Smartphone Users.” Emarketer. 30 July 2015.

2 “Latin American Internet Audience Nears 310 Million.” Emarketer. 4 December 2014.

3 “The Internet and Mobile Waves Catch Up With Latin America.”Sojern: Ad Tech. 2 September 2015.

4 Huenchuan, Sandra. “Ageing, Solidarity and Social Protection in Latin America and the Caribbean.” Economic Commission for Latin America and the Caribbean (ECLAC). February 2013.

5 Aggerwal A., Unger-Saldana K., Lewison G., and Sullivan R. “The Challenge of Cancer in Middle-Income Countries with an Ageing Population: Mexico as a Case Study.” ECancer. July 2015.

6 Munos-Louis R., Medrano-Sanchez J., Montufar R. “Rheumatoid Arthritis in Latin America: Challenges and Solutions to Improve Its Diagnosis and Treatment Training for Medical Professionals. Clinical Rheumatology. 31 July 2015.

7 Al Snih S. “Prevalence of Self-reported Arthritis Among Elders from Latin America and the Caribbean and Among Mexican Americans from the Southwestern United States.” Journal of Aging and Health 18:2. April 2006.

8 “Rising Prevalence of Chronic Diseases Propels Latin America Home Healthcare Market to US$17.5 bn by 2020.” Transparency Market Research. 12 October 2015.

9 “HRI/CIS Wearables Consumer Survey.” PwC. 2014.

10 “Wearable Technology Market is Expected to be USD 5.8 billion by 2018 at CAGR of 40.8% From 2012 to 2018: Transparency Market Research.” PR Newswire, July 2015.

11 “mHealth Solutions Market Worth 59.15 Billion USD by 2020.” Markets & Markets. 2015.

8. Specialty medical devices: growth rates of over 20% in 2015

1 Martinez, Antonio. “Healthcare Multinationals Face New Reality in Latin America.” Frontier Strategy Group. 2015.

2 Sassi, Franco. “Obesity and the Economics of prevention: Fit Not Fat.” OECD. Page 28. 2014.

3 “US and Global Obesity Levels: The Fat Chart.” ProCon. 11 August 2011.

4 Gupta S., Richard L. “Is Obesity Really a Problem in Brazil?” PMLive. 20 January 2015.

5 “Mexico Obesity Rate Surpasses The United States’, Making It Fattest Country In The Americas.” The Huffington Post. 20 August 2015.

6 Pérez, Melina. “5 of the World’s Most Overweight Countries.” The Richest. 03 April 2014.

7 “Integrated Disease Management: Diabetes.” WHO/PAHO.

8 University of Michigan. “Nationwide Look at Diabetes in Mexico Paints Grim Picture.” Medical Xpress. 18 November 2015.

9 “2015 Global Healthcare Outlook: Common Goals, Competing Priorities.” Deloitte.

10 Associação de Diabetes Juvenil. “Encouraging healthy futures for Brazil’s children.” DiabetesVoice 58:1. September 2013.

9. Capital equipment: Portability and mobility to drive demand

1 GHI Analysis based on: SA-BRC. “Global Medical X-ray Devices Market is Forecast to Reach US$ 10,334.8 Million by 2019; CAGR of 4.4% from 2015 to 2019.” Virtual-Strategy Magazine, July 2015.

2 GHI Analysis based on: Persistence. “Latin America Market Study on Capnography Equipment: Brazil to Witness Highest Growth by 2021.” PR Newswire, June 2015.

3 GHI Analysis based on: Thoras, Michelle. “Global Portable X-Ray and CT Scan Devices Market Is Expected to Reach USD 8,408 million by 2020.” medGadget, September 2015.

4 Stillwell, Andrew. “Could Enterprise be the Spark the Wearables Market Needs to Ignite Customer Sales?” GFK Technology, September 2015.

5 Nixon, Patrick. “Chile, Brazil leading Latin American wearables sales for Samsung.” BNamericas, December 2014.

6 Mordor Intelligence. “Mexico Wearable Sensors Market – Growth, Trends and Forecasts (2015-2020).” August 2015.

7 GHI analysis based on “Home healthcare Market worth 349.8 billion USD by 2020.” Markets and Markets, 2015.

www.globalhealthintelligence.com 14

About Global Health Intelligence

Global Health Intelligence (GHI) provides groundbreaking and accurate information about healthcare systems in Latin America and Asia to enable multinational firms to grow and understand the competitive landscape in these markets.

The data provided by GHI focuses on hospital demographics, import data, and custom research in order to help businesses succeed in emerging healthcare markets.

HOSPITAL DEMOGRAPHICS

GHI has the world’s largest hospital database focused on emerging markets, covering data such as number of beds, medical practices, capital equipment, procedures, among others.

MARKET SIZING

GHI has the most expansive medical import statistics in Latin America, including data such as importer, exporter, quantity and value of goods traded.

CUSTOM RESEARCH

GHI consultants have over 20 years of market intelligence experience in emerging markets, helping companies find answers to complex questions and market situations.

Customers include medical device manufacturers, medical technology providers, pharmaceutical companies, medical equipment providers, private equity and solutions integrators, among others.

To learn more about Global Health Intelligence, our services, consulting engagements and speaking opportunities, please contact:

Guillaume Corpart, Managing Director

+1 (305) 441-9300 x302

gc@globalhealthintelligence.com

First published in January 2016 by Global Health Intelligence.

© 2015, 2016. Global Health Intelligence. All rights reserved.

This document contains confidential information and is the sole property of Global Health Intelligence. No part of it may be circulated, quoted, copied or otherwise reproduced without the written approval of Global Health Intelligence

www.globalhealthintelligence.com 15