In May 2021, the Dominican Republic launched the Hospital Program for the Timely Detection of Breast, Cervical and Prostate Cancer, whose main objective is “to provide access to citizens through a network of establishments that will provide laboratory tests, imaging studies, hospitalization in cases that require it, medical procedures, gynecological and oncology consultations, as well as treatment.” The program has a network of establishments detailed on the SNS website, which also specifies the target population for the program and its expected benefits.

In an analysis of procurement trends in Dominican hospitals recently carried out based on the compound annual growth rate (CAGR) between 2019 and 2023 and other analyses, Global Health Intelligence (GHI) has identified that a large part of the devices and equipment needed for the treatments contemplated in the aforementioned hospital program are those with the highest sales projections. Below we share with you the types of medical equipment with the highest projected growth, as well as the types that will contract the most by 2022.

The 10 Medical Equipment Categories with the Greatest Projected Growth in the Dominican Republic in 2022

Mammography equipment in Dominican hospitals

Projected 52% increase in 2022

PET scanners in Dominican hospitals

Projected 40% increase in 2022

Gamma cameras in Dominican hospitals

Projected 36% increase in 2022

Patient monitors in Dominican hospitals

Projected 31% increase in 2022

Angiograms in Dominican hospitals

Projected 16% increase in 2022

Endoscopes in Dominican hospitals

Projected 12% increase in 2022

C-arms in Dominican hospitals

Projected 10% increase in 2022

Radiotherapy equipment in Dominican hospitals

Projected 10% increase in 2022

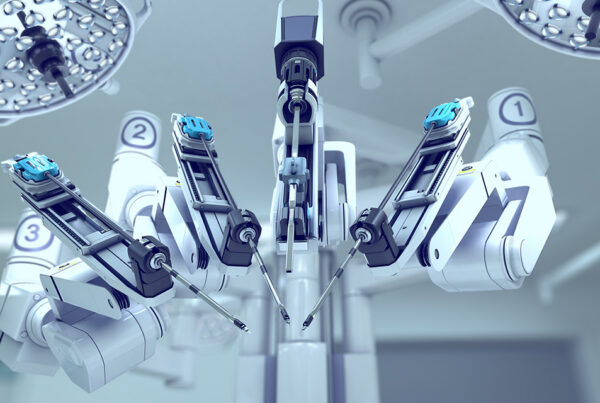

Laparoscopic equipment in Dominican hospitals

Projected 9% increase in 2022

Ventilators in Dominican hospitals

Projected 6% increase in 2022

The 5 Medical Equipment Categories with the Highest Projected Contractions in the Dominican Republic in 2022

RIS in Dominican hospitals

Projected 53% contraction in 2022

Stereotactic mammography machines in Dominican hospitals

Projected 32% contraction in 2022

Hyperbaric chambers in Dominican hospitals

Projected 17% contraction in 2022

PACS in Dominican hospitals

Projected 16% contraction in 2022

Fluoroscopes in Dominican hospitals

Projected 16% contraction in 2022

Next Steps

Contact us to obtain more detailed data on the medical equipment market in the Dominican Republic. We can help with several key resources, such as:

HospiScope: Subscribing to this database allows you to access millions of data points for nearly 90% of the hospitals in Latin America.

SurgiScope: Subscribing to this database allows you to see the surgical procedures taking place in hospitals in LatAm’s key hospital markets, which in turn can be used to gauge market demand for your products, market projections and more.

ShareScope: This service reveals market share in different markets for more than 30 different types of medical equipment.

LatAm Hospital Monitoring Service: Subscribing to this service gives you weekly updates on Latin American hospitals in the country of your choice, all accessible through a power business intelligence platform that features cutting-edge data visualization tools.

In-Scope: Customized research into the LatAm medical equipment market of your choice that will deliver a proprietary report offering the insights you need to make strategic decisions in 2022 and beyond.