While in the past we have noted growth in Latin America’s healthcare system — surging equipment counts, increasing demand for pharmaceuticals and equipment — it’s also important to highlight the persistent challenges, especially with infrastructure.

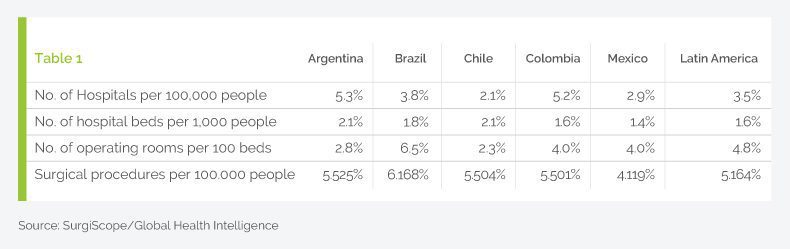

Recently we analyzed data from our HospiScope and SurgiScope databases to see if there was a relationship between hospital infrastructure and surgical procedures in Latin American hospitals. We started by calculating average figures for the 14 countries in our HospiScope database in terms of some basic infrastructure areas, along with the amount of surgical procedures performed.

This gave us a regional baseline where we observed that there were:

- 3.5 hospitals per 100,000 people in Latin America

- 1.6 hospital beds per 1,000 people

- 4.8 operating rooms per 100 hospital beds

- 5,164 surgical procedures per 100,000 people

We then compared this Latin American baseline to numbers in the 5 top hospital markets in the region.

This analysis lets us see which hospital markets are performing above or below the regional average in the four categories we highlighted in our analysis. Mexico is below the regional average in all categories, while Brazil has a deeper hospital infrastructure and is above the regional average in most of these categories. Colombia and Argentina are above the regional averages in 3 out of the 4 measures, while Chile posted higher than average numbers in two of the four categories.

This analysis lets us see which hospital markets are performing above or below the regional average in the four categories we highlighted in our analysis. Mexico is below the regional average in all categories, while Brazil has a deeper hospital infrastructure and is above the regional average in most of these categories. Colombia and Argentina are above the regional averages in 3 out of the 4 measures, while Chile posted higher than average numbers in two of the four categories.

Weaker Infrastructure Affects LatAm Surgical Procedure Types

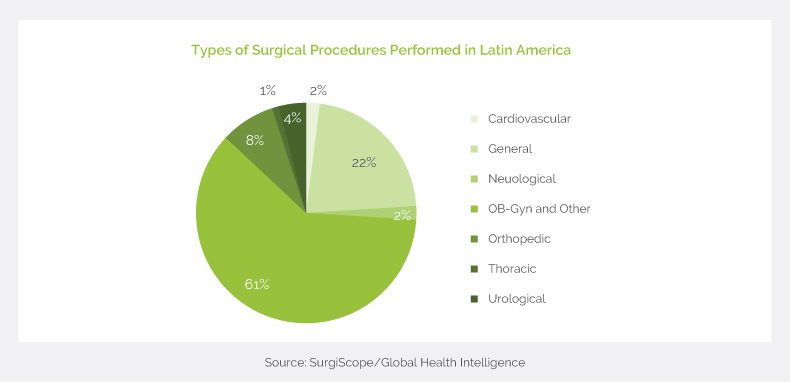

The practical impact of these differences in hospital infrastructure is felt in the surgical procedures performed in Latin America. Generally speaking, cardiovascular, neurological and urological procedures tend to be more complex and require more sophisticated hospital infrastructure, including installed base equipment. The breakdown below of the most common surgical procedures performed in Latin America shows that these more complex procedures types are performed much less:

While 61% of the surgical procedures performed in Latin America fall into the OB-GYN and Other category, only 2% are cardiovascular or neurological and 4% are urological.

While 61% of the surgical procedures performed in Latin America fall into the OB-GYN and Other category, only 2% are cardiovascular or neurological and 4% are urological.

The same pattern shows up in the top 5 hospital markets in the region:

Across the board, OB-GYN and Other is the top category for surgical procedures performed in Latin America (ranging from 55% to 66%), while cardiovascular ranges from 1% to 5%, neurological from 1% to 3% and urology from 2% to 15%.

Across the board, OB-GYN and Other is the top category for surgical procedures performed in Latin America (ranging from 55% to 66%), while cardiovascular ranges from 1% to 5%, neurological from 1% to 3% and urology from 2% to 15%.

The pattern is particularly pronounced in Mexico, where only 1% of surgical procedures are cardiovascular or neurological, and only 2% are urological.

On the other hand, Brazil leads the region in percentage of cardiovascular surgeries (7%), as well as urological (15%).

Given that Brazil has nearly double the amount of hospitals of Mexico and that 9% of its GDP is focused on healthcare (as opposed to 6% for Mexico), this extra infrastructure could be one of the elements responsible for the difference between the two countries.

Another factor is that public hospitals literally loom much larger in Mexico: on average, they are 7 times larger than private hospitals. In the rest of Latin America, public hospitals are only twice as large, on average, as private hospitals. Given that the resources of public hospitals in Mexico are stretched thin by having to care for an enormous swath of the population, this could also result in fewer complex surgeries and more of a focus on simpler procedures that are less resource-intensive.

Efficiency and productivity of healthcare services are other factors that affect procedure breakdown, each of which are treated in other articles.

Explore More

Our suite of services is designed to help medical equipment and pharmaceutical companies operating in Latin America to improve salesforce effectiveness via deeper market intelligence, expand their market shares, counteract rivals with competitive intelligence, drive strategic planning and more.

Contact us to see how we can help your company expand its LatAm footprint.