Latin America is getting older, heavier and sicker. We’ve talked about this before in our 5 Megatrends in Latin American Healthcare whitepaper, and this macro-movement shows no signs of slowing down, much less stopping.

Due in no small part to these large-scale changes, demand for certain types of medical devices and equipment in Latin America is projected to expand strongly in the next few years. Of course, this projected demand, which is obviously an expectation rather than a measured fact. To test whether this projected demand is accurate, below we break down the medical equipment and devices categories in Latin America with the highest forecast demand, and then compare them to the real growth we observed in 2018 in the acquisition of equipment by the region’s hospitals.

DROPS:

The number of ultrasound machines in operation were down in 4 LatAm markets in 2018, including Colombia, Costa Rica, Panama and Uruguay, ranging from 0.3% down to as much as 12.4% down.

AVERAGE GROWTH AS PER GHI

3.47% [in all 14 markets tracked by HospiScope in 2018]

DIFFERENCE: -3.46%

This is significant, but GHI’s figures are for one year and the projection runs through 2023. Between now and then, the macro-trends suggest demand could definitely increase, especially when we consider the surgical procedures most often performed in Brazil and Mexico, along with the growing rates of conditions that require ultrasound machines for diagnostics.

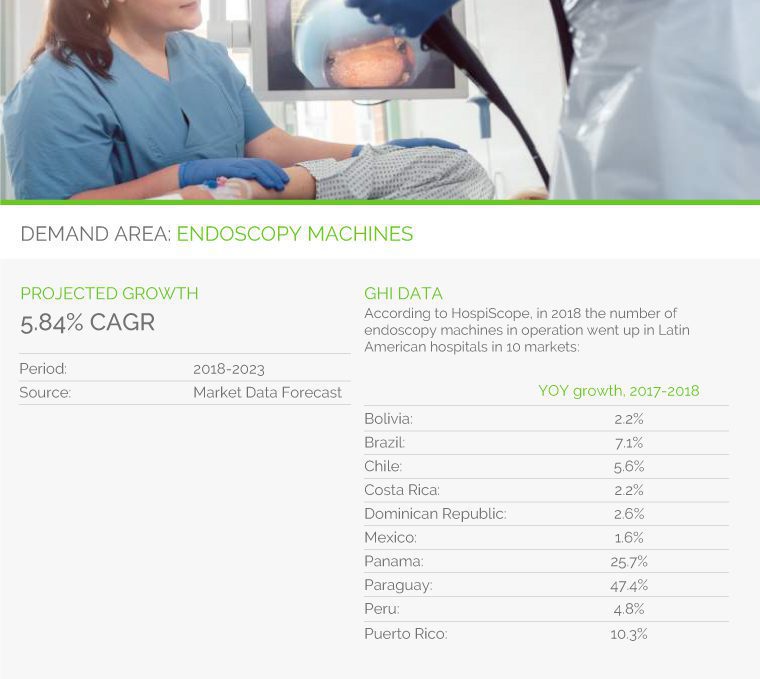

DROPS:

The number of endoscopy machines in operation were down in four LatAm markets in 2018, including Colombia, Costa Rica, Panama and Uruguay, ranging from 1.7% down to as much as 6.7% down.

AVERAGE GROWTH AS PER GHI:

5.24% [in all 14 markets tracked by HospiScope in 2018]

DIFFERENCE: -.60%

The projected growth for endoscopy machines in Latin America is similar to the increase we saw in 2018 among Latin American hospitals, suggesting that the projected CAGR could end up being a reality.

DROPS

Counts of MRI machines were down in seven LatAm markets in 2018, including Peru, Colombia, Paraguay and Uruguay, ranging from 1.4% down to as much as 44% down.

AVERAGE GROWTH AS PER GHI:

5.0% [in all 14 markets tracked by HospiScope in 2018]

DIFFERENCE: -1.5%

The difference is not enormous, suggesting that by 2023 we could see the projected growth rate reflecting true increases in acquisitions by hospitals.

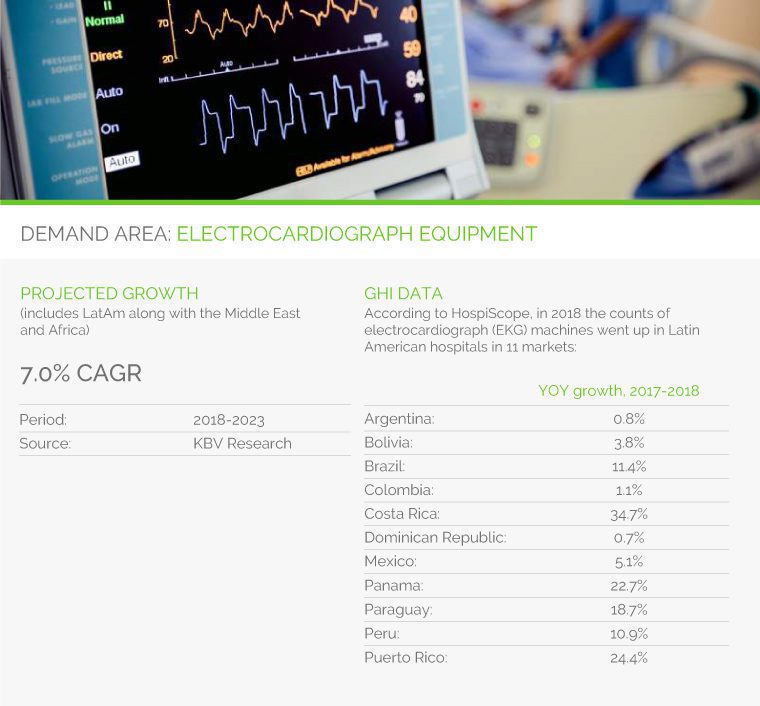

DROPS:

Counts of EKG machines were down in 3 LatAm markets in 2018, including Chile, Guatemala and Uruguay, ranging from 1.6% down to 6.5% down.

AVERAGE GROWTH :

9.64% [in all 14 markets tracked by HospiScope in 2018]

DIFFERENCE:

This isn’t comparable because KBV’s projection includes other regions besides Latin America.

DROPS:

Counts of X-ray machines were down in 5 LatAm markets in 2018, including Argentina, Colombia, Costa Rica, Paraguay and Uruguay, ranging from 0.9% down to 5.4% down.

AVERAGE GROWTH AS PER GHI: 2.55% [in all 14 markets tracked by HospiScope in 2018]

DIFFERENCE:

This isn’t comparable because Mordor’s projection only covers portable X-ray machines and only South America.

Next Steps

Of course, this data represents only a sliver of the analytics capabilities that are available with GHI’s databases and services. To go further, reach out for a demo of:

InstaScope: market size/share for 41 equipment/device categories in 13 countries

SurgiScope: Surgical procedures carried out in key LatAm markets

HospiScope: The largest hospital demographics database for Latin America in the world, now expanded to include 17 countries

In-Scope: Personalized research—including competitive intelligence—for companies looking for specific data and analysis to drive major business decisions