Examining medical device import trends offers intimate insight regarding the pressures and demands affecting the industry. This analysis reveals opportunities for global players and regional leaders alike.

In 2015, imports of capital equipment for the medical field contracted slightly from $5.2 billion to $5.1 billion year-over-year (YoY). Despite stagnant numbers, there are still a number of profitable product classes in response to the region’s epidemiological transition, where ageing populations and a pervasive obesity epidemic have left countries facing a high prevalence of non-communicable diseases (NCDs). Deaths stemming from chronic diseases are projected to reach 84% by 2030, this is—and will continue to be—the primary driver for capital equipment imports in coming years.2

Mexico, Brazil, Argentina and Colombia account for over 80% of the region’s import and sales of capital equipment. All of these countries have made efforts to revitalize their healthcare systems that present opportunities for manufacturers, distributors and integrators alike.

In spite of the worsening economic downturn, the Brazilian government allocated funds towards teaching hospitals and improving specialty services in 2015; Mexico has initiated plans to streamline their medical imports as well as proposed initiatives to migrate systems to electronic medical records (EMRs); and Argentina has initiated their National CyberHealth Plan to expand patient outreach.

Manufacturers, distributors and integrators can expect sustained interest in capital goods, led by diagnostic and patient monitoring equipment. Given the continued need for capital equipment as well as the financial constraints of payers, second-generation and certified refurbished equipment may gain traction.

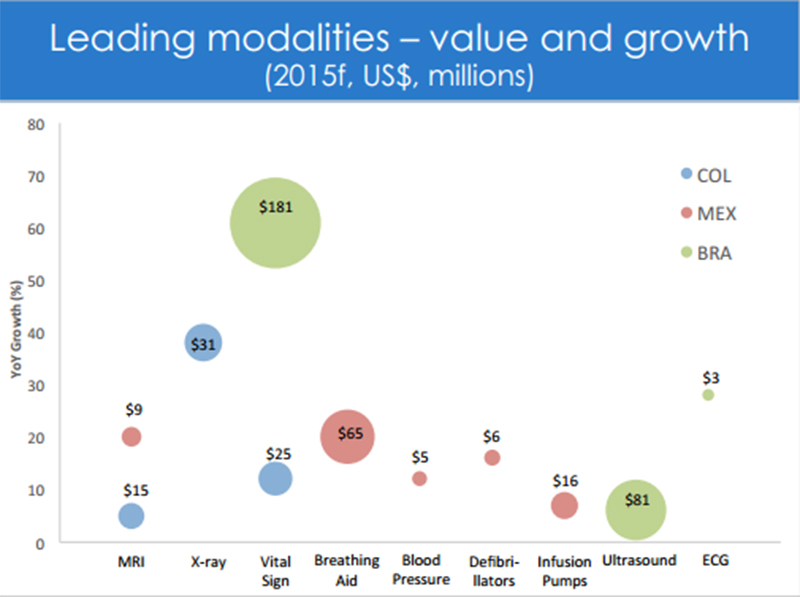

In Mexico, infusion pumps rank as the dominant product class for the country’s imports, displaying a 7% YoY increase. Breath-enhancing machines (such as ventilators and nebulizers) as well as defibrillators experienced the highest growth, with a 20% YoY increase (to reach a market value of $98 million), and a 23% YoY increase (to reach a market value of $9.4 million), respectively. Other product classes showing significant growth are blood pressure monitors, with a 2% YoY increase to reach a market value of $11.6 million. Such gains are not exclusive to Mexico. Brazil’s highest-growth product class, electrocardiograph machines, increased 28% to reach $4.0 million. The country also saw growth of 6% in ultrasound machines, reaching a market value of $107 million. Meanwhile, Colombia displayed a 5% YoY growth in MRI machines, reaching $15 million by year-end 2015.

Suppliers should heed the cardiorespiratory-centric nature of Latin America’s imported capital equipment; such focus is not

Source: Global Health Intelligence, 2015

Source: Global Health Intelligence, 2015

coincidental. Currently, Mexico, Venezuela and Argentina are among the most obese countries in the world; bleak overweight rates in Brazil, Colombia, and other countries foreshadow the same trend elsewhere in the region. 3-6 Simultaneously, the potentially fatal conditions that go hand in hand with the obesity epidemic and an ageing population (e.g., diabetes, cardiovascular diseases, blood vessel blockage) are expected to continue rising.4,8,9 Hence the significant potential for the diagnostic and treatment capabilities of infusion pumps, defibrillators, MRIs, electrocardiographs, blood pressure monitors, and ultrasound machines, which address the acute and chronic symptoms of these diseases and their associated risk factors. Suppliers should expect resilient growth in products aimed towards insulin management, hypertension, atherosclerosis, embolism/thrombus formation, and decreased pulmonary function.

Given gradual ageing of the population, the spread of chronic diseases, and forecasts indicating region-wide growth in healthcare spending of 4.8% per year through 2018, the demand for these product classes will persist in the near future.9 Additional opportunities exist in aligning portable patient monitoring devices with government awareness and education campaigns. Existing government programs could use these devices to further public health objectives. Such is the case of Mexico’s National Strategy for Prevention for Control of Overweight, Obesity and Diabetes and Brazil’s School Education Program, which also encourage awareness and lifestyle changes.10

There is a clear regional trend to embrace products made “simple and convenient”, with portability features and home use in mind, particularly if these are able to strengthen the patient-doctor relationship.

www.globalhealthintelligence.com 11