By Guillaume Corpart

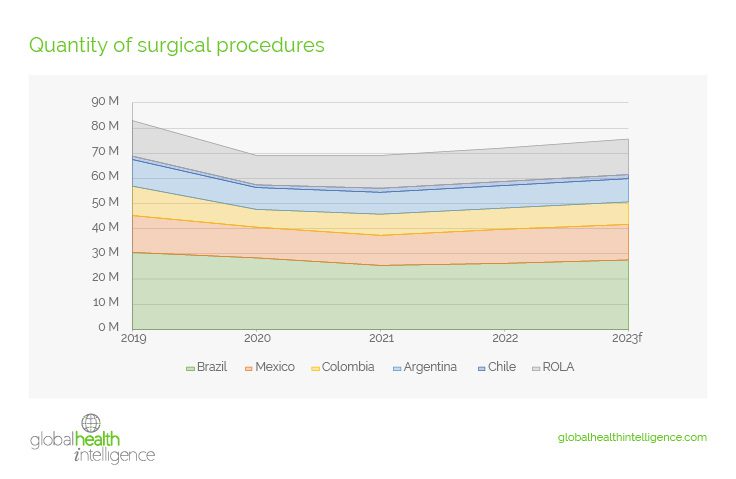

During the height of the COVID-19 pandemic in 2020, hospitals saw a significant decrease in surgical procedures around the globe. In Latin America specifically, the pandemic resulted in a 16.6% drop in procedure volumes, bringing an end to what was a healthy and growing medical market.

Since that initial decline, procedure volumes have rebounded somewhat, but they’ve struggled to get back to their pre-pandemic levels. While some medical centers have recovered nicely, this is not the case for all establishments or all procedures, much less for the region as a whole.

The Last Four Years: An Overview

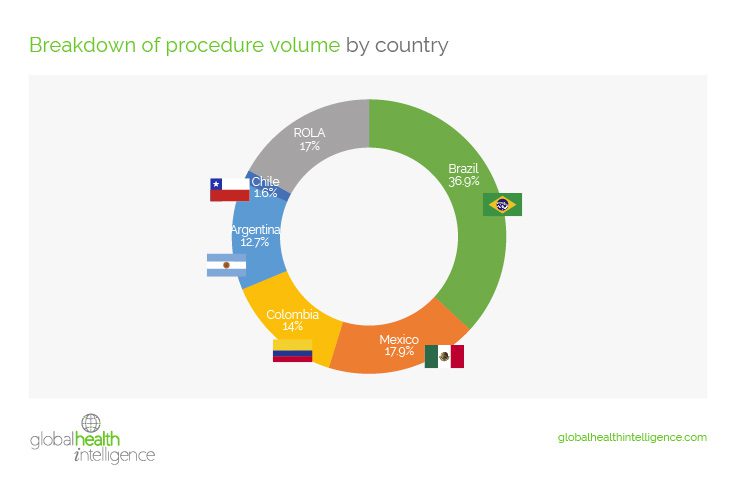

Before the pandemic, the surgery business was booming. Latin America registered 82.9 M surgical procedures in 2019. Brazil accounted for 36.9% of those procedures, followed by Mexico (17.9%), Colombia (14.0%), and Argentina (12.7%).

As the lockdowns took effect across the region in early 2020, however, hospitals focused their resources on treating COVID patients. Surgical procedure volume dropped by 17% as only the most severe cases were treated. Colombia implemented of some of the most restrictive COVID policies in the region, which caused their surgical procedures to drop by nearly 40% in 2020.

The impact of the pandemic was even more severe for diagnostic and therapeutic procedures. During this time, medical companies were working hard to supply institutions with the equipment they needed to treat patients, all while paying close attention to market trends to see when if and when the pandemic would stop. Bailout money flowed lavishly as government aid made its way to corporate coffers.

By 2021, hospitals across the region had stabilized their operations, and certain markets began to see a long-anticipated rebound in surgical procedure volume. However, this growth did not reach the level that many experts had hoped for.

Overall, Latin America showed neither growth nor contraction in the number of surgical procedures conducted. Plus, the results were decidedly mixed depending on which country you analyzed. For example, Brazil posted a double-digit contraction in surgical procedure volume, while Chile and Colombia both experienced a double-digit rebound. Medical equipment companies eagerly waited for hospitals to recover their procedure volumes and shift their spending back into supplies for the operating room. Government money continued to arrive, boosting corporate finances and creating what came to be known as the “COVID Bonus.” Signs of inflation were starting to show, an omen for the economic situation to come.

The regional rebound in surgical procedure volumes finally arrived in 2022 with 4.6% growth. During that year, the expansion was fueled primarily by private institutions in Mexico. After two consecutive years of contraction, Mexico bucked this trend with a double-digit increase in procedures.

While this is undoubtedly a breath of fresh air for the industry, the recent growth is not enough to reach pre-pandemic levels. By the end of 2022, surgical procedure volume in Latin America remained 8.6% below 2019 levels.

Other Mitigating Factors

The turmoil experienced in the wake of the COVID-19 pandemic has been further exacerbated by political factors, such as the potential restructuring of the healthcare sector in Colombia and the court order obliging private entities (Isapres) to reimburse excess fees in Chile. Hospital systems throughout the region are facing similar challenges and finding themselves squeezed financially as a result.

The fallout is that medical companies continue to cope with tight budgets in both the public and private sectors. Many medical companies had to restructure parts of their operations to reduce overhead in 2022 and 2023. These factors certainly played a role in the contraction in surgical procedure volume seen in recent years. While surgical procedure volumes are expected to keep growing in what remains of 2023, this growth is not forecast to reach pre-pandemic levels.

In such times, client segmentation becomes ever more critical. Being able to identify which institutions conduct specific procedures can be the difference between growing in the market or suffering from contraction. GHI has an array of tools that can help you map procedures at the institutional level (SurgiScope), as well as conduct propensity analysis to identify qualified prospects (HospiScope). Contact us to find out more.