A common perception surrounding Latin American hospitals and medical centers is that they lag behind the centers of the United States and Europe when it comes to adopting new technologies. However, recent years have shown a refutation of that trend.

Various countries in the region have begun to adopt more advanced surgical tools and equipment. In particular, minimally invasive equipment used for endoscopy, laparoscopy or robotic-assisted procedures has shown substantial growth. Let’s take a closer look at the numbers.

Endoscopy

One medical technology that has seen significant growth and is expected to grow even more in the coming years is endoscopy. An endoscope is a long, flexible tube that can be inserted inside the body to examine internal organs with a light and a camera. In many cases, surgical instruments can be inserted through a channel in the endoscope to remove tissue or perform other surgical procedures.

Endoscopes are often thought of as tools for digestive procedures and are inserted through the mouth or anus, but there are other forms of endoscopy, as well. These include arthroscopy, cystoscopy, hysteroscopy and many more.

In recent years, endoscopy has shown consistent growth in Latin America that has outpaced the growth of other surgical equipment. For example, the “installed base” of equipment in 2023 overall grew by just 4.7%, but endoscopes grew by 10.2% that year, and endoscopy towers grew by 13.7%.

Endoscopy in Latin America by the Numbers

- Revenue of the Latin American endoscopic device market in 2025: $2.2b

- Projected revenue of the market by 2030: $3.1b

- Projected compound annual growth rate (CAGR): 7.14%

Growth in the endoscopy market is consistent all over the region, but major markets like Argentina, Mexico and Brazil are major drivers, with projected CAGRs of 13.6%, 10.1%, and 9.7% respectively.

Laparoscopy

Laparoscopy is a form of endoscopy, but it’s specifically used to examine and treat the organs of the abdomen and reproductive system via an incision in the abdomen. Like other endoscopic equipment, however, laparoscopy has seen major growth in Latin America in recent years, continued growth in the market is anticipated.

Laparoscopy in Latin America by the Numbers

- Revenue of the Latin American laparoscopic device market in 2023: $2.35b

- Projected revenue of the market by 2033: $4.61b

- Projected compound annual growth rate (CAGR): 7.79%

Like endoscopic equipment in general, laparoscopic equipment has shown growth throughout the region but particularly in countries like Brazil and Mexico, at 12.9% and 9.2% growth in 2023, respectively. Chile also showed significant growth in the laparoscopic equipment market with 12% growth in 2023, while Argentina and Colombia lagged behind at 5% and 4.9% growth that year.

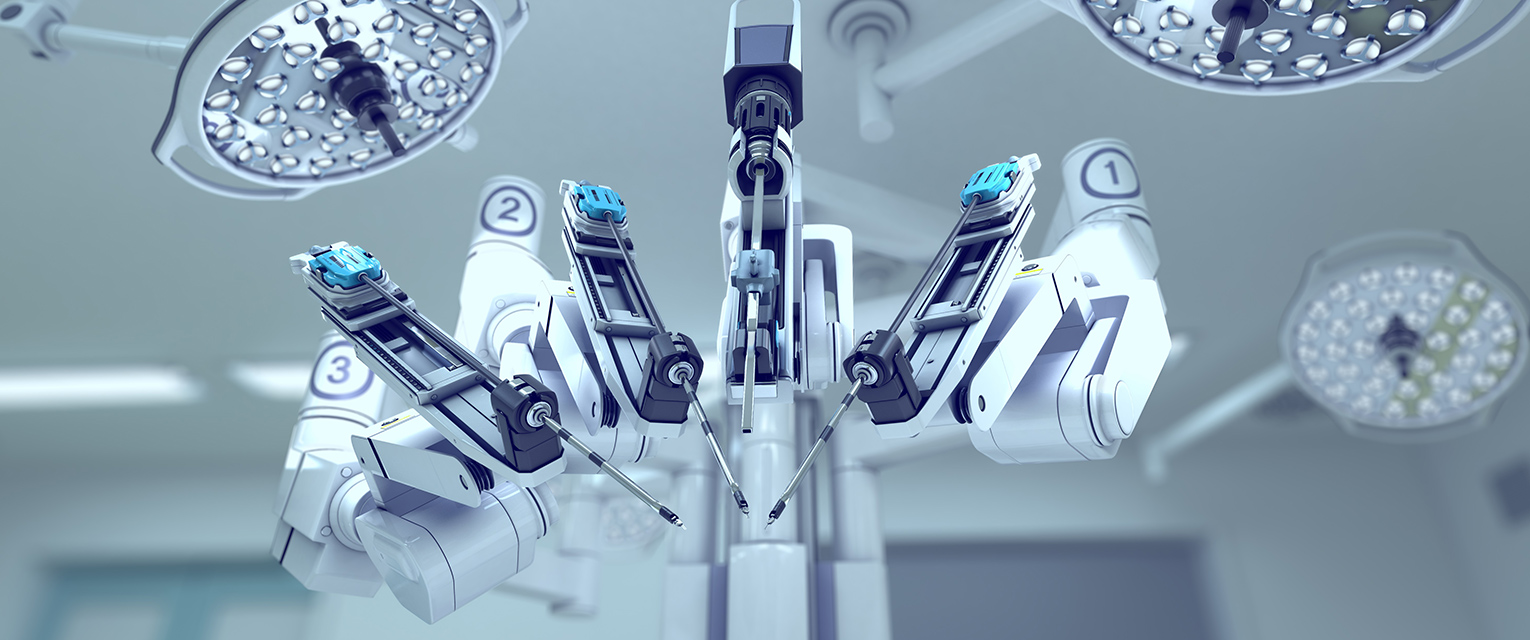

Robotics

Robotic-assisted surgery is a growing market worldwide, and while the reach in Latin America is still fairly small, it’s also showing significant growth, as well as a projected forecast for growth in the years ahead.

Surgical Robotics in Latin America by the Numbers

- Revenue of the Latin American surgical robotics market in 2024: $246.6m

- Projected revenue of the market by 2033: $573.2m

- Projected compound annual growth rate (CAGR): 9.8%

Here again, the demand for surgical robots in Brazil and Mexico is ahead of the rest of the region, but all of Latin America is seeing a rising demand and a forecast for increasing revenues over the next decade.

Why the Rise in Demand?

As these numbers indicate, Latin America is ready and willing to spend the money to update its medical technology and bring its facilities up to date with the latest equipment and devices. What prompted this pivot in the region? The answer is multi-faceted, but one theory is that the COVID-19 pandemic exposed many of the shortcomings of the Latin American healthcare system. Since then, administrators and patients have demanded better treatments, which requires better technology.

Of course, other factors are at play here, as well. Patients are learning more about the less invasive medical procedures that are now available from equipment such as endoscopic, laparoscopic and robotic devices, and they are demanding that their treatments be performed this way. Chronic diseases such as obesity, heart disease and diabetes are also becoming more prevalent, which requires more diagnoses and procedures be performed with these tools.

Upgrading to the latest equipment has benefits for the healthcare facilities as well as the patients. Less invasive procedures from endoscopy, laparoscopy and robotics have improved outcomes and shorter hospital stays. This creates greater satisfaction rates among patients and allows the hospitals to see more patients in a shorter amount of time.

Barriers to Adoption

As with all changes in technology, there are challenges along the way as hospitals begin to upgrade. New equipment is costly, and many public facilities lack the budgets to upgrade as much as they’d desire. This is why some of these devices and equipment, particularly robotics, are growing at a faster rate in private hospitals than in public ones. Even so, tools like endoscopes and laparoscopes are increasingly being seen as the standard of care for many procedures, which puts pressure on public health systems to upgrade, regardless of the associated costs.

Other barriers include the challenges of training or hiring healthcare professionals to run these new devices and equipment. This can make the costs and challenges much greater than simply acquiring the equipment. However, most facilities report long-term benefits in terms of efficiency, outcomes and patient satisfaction when they make these initial investments.

Key Takeaways for Health Care Companies

If your company is in the surgical device and equipment market, these numbers clearly indicate that the entire Latin American region is ripe for growth in the years ahead, particularly in the endoscope, laparoscope and robotics markets. Now is the time to finetune your strategy, not only for private hospitals, but also for the public healthcare systems that are trying to keep up with patient demands.

You can rely on GHI and its suite of data solutions like HospiScope and SurgiScope to check hospital inventory and tailor your strategy where the greatest needs exist. There’s no question that this market will only continue to grow, so it’s time to finalize and implement your sales strategy for 2026 and beyond.

Next Steps

Contact GHI to learn more about surgical trends and their potential impact on the medical device and equipment markets in Latin America. Our team of researchers can provide the analysis you need to gain valuable insights to support strategic decision-making in your industry.

************

Sources:

- https://my.clevelandclinic.org/health/diagnostics/25126-endoscopy

- https://my.clevelandclinic.org/health/procedures/4819-laparoscopy

- https://www.grandviewresearch.com/horizon/outlook/endoscopes-market/latin-america

- https://www.grandviewresearch.com/horizon/outlook/endoscopes-market/argentina

- https://www.grandviewresearch.com/horizon/outlook/endoscopes-market/mexico

- https://www.grandviewresearch.com/horizon/outlook/endoscopes-market/brazil

- https://www.statista.com/outlook/hmo/medical-technology/medical-devices/endoscopic-devices/latam?srsltid=AfmBOoqlTFhssZ09QS62ZAn9yXFNMPQYkI44NhKsNsZQSRODDFzODjZz

- https://www.marketdataforecast.com/market-reports/latin-america-endoscope-reprocessing-market

- https://www.businessmarketinsights.com/reports/latin-america-laparoscopic-devices-market

- https://www.marketdataforecast.com/market-reports/latin-america-laparoscopy-device-market

- https://www.grandviewresearch.com/horizon/outlook/surgical-robots-market/latin-america

- https://www.tritonmarketresearch.com/reports/latin-america-surgical-robotics-market

- https://globalhealthintelligence.com/ghi-analysis/parsing-the-robotic-surgery-market-in-latin-america/