Guillaume Corpart

Latin America is currently undergoing a seismic geopolitical realignment. A region long known for foreign intervention, first by Europe and then the US via the Monroe Doctrine, is once again becoming a primary theater for great power competition. This shift is not merely rhetorical; it is characterized by a significant, assertive re-engagement by the United States that is aimed at rolling back external influences and cementing hemispheric dominance.

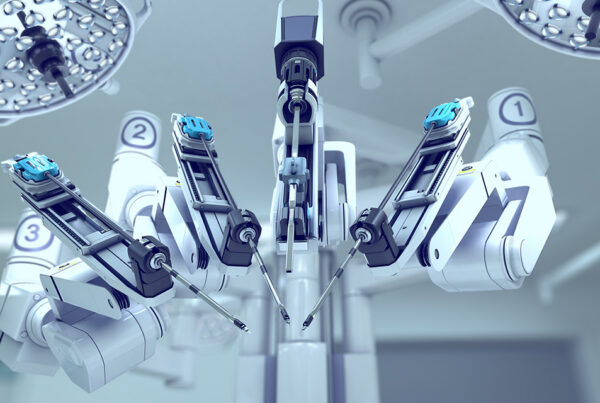

This aggressive geopolitical pivot has profound implications for commercial sectors across the board. However, few industries are as sensitive to these shifts — or as critical to national stability — as the medical equipment and device market. As Washington exerts newfound economic and military pressure on the region, the market for medical equipment and devices will face its most significant disruption since the onset of the COVID-19 pandemic.

The Hard Power Pivot: Washington Reasserts Control

For years, US influence in Latin America was viewed as waning and characterized by neglect that allowed other global actors to step into the void. That era now appears to be over. Washington has initiated a strategy defined by hard power and coercive diplomacy aimed at ensuring regional alignment with US interests.

The most startling manifestation of this new reality is the recent operation that resulted in the capture of Venezuelan President Nicolás Maduro. This action sent a shockwave through every capital in the Western Hemisphere and showed that the US is willing to utilize direct intervention to achieve its strategic goals.

On a smaller scale, the US is still trying to impose its will on the region in other ways. Thinly veiled warnings directed at key regional players like Mexico and Colombia regarding trade compliance, migration enforcement, and drug policy have reinforced the message: Alignment with Washington is no longer optional.

These actions inevitably create severe tensions in commercial relations among nations. When diplomacy is conducted through the lens of national security and military capability, standard trade relationships become volatile. Sovereignty concerns are heightened, and nations become wary of economic leverage being used as a political weapon. The immediate outcome of this posture is a climate of uncertainty that forces Latin American governments to recalculate their foreign policy risks, their economic priorities, and their alliances.

The Context: The Dragon in the Operating Room

To understand the impact of this US resurgence on the medical market, one must first understand the status quo. Over the past decade, and accelerating dramatically during the COVID-19 pandemic, China has become the undisputed primary supplier of medical devices and equipment to Latin America.

When the pandemic struck and Western nations hoarded ventilators, PPE, and diagnostic tools, Beijing stepped in with “mask diplomacy.” Even amidst manufacturing limitations, trade restrictions, and logistical barriers, Chinese manufacturers provided rapid, affordable access to medical equipment when few others could or would.

Consequently, Chinese products — from high-end imaging scanners in Brazilian hospitals to basic consumables in Peruvian clinics — became ubiquitous throughout Latin America. This dominance was built not just on price, but on availability and a lack of viable alternatives during a global emergency. In recent years, this trend solidified, with Chinese medical imports frequently outpacing American products across the region.

Chinese medical products went from representing 25% of imports into Latin America in 2018 to 34% in 2024. Meanwhile, the share of US imports into the region fell from 38% to 28% over the same period. This trend was seen most notably in Brazil, Colombia, and Chile, where Chinese products represent over 50% of all medical devices imported.

The Short-Term Shock: A Forced Realignment

The newfound US assertiveness is poised to disrupt this Chinese-dominated landscape almost immediately. In the short term, we can expect the US to leverage its political wins (like the neutralization of the Maduro regime) and its pressure campaigns on Mexico and Colombia to force a commercial pivot.

Over the next 24 months, we are likely to see the opening of a long-forgotten healthcare market in Venezuela. Interestingly, the seizing of Venezuelan oil and the fall of the Maduro regime has also placed immediate pressure on Cuba’s already fragile system, so Cuba may well be the subsequent market to open to investment.

Healthcare systems in both Venezuela and Cuba will need to be redesigned. The initial focus will be placed on increasing access to primary care, with investments in specialized hospitals occurring in a secondary phase. Immediate opportunities will arise in almost every area of the healthcare system, from the rebuilding of hospital infrastructure to technology, equipment, devices, consumables, and pharmaceuticals. Infrastructure, distribution, servicing, and financial models will need to be reassessed and, in many cases, rebuilt from the ground up.

In established and existing markets, we can expect explicit demands or strongly worded “guidance” for Latin American health ministries to favor US partnerships over alternatives such as the current Chinese trade agreements. This could be facilitated via free trade agreements, tariffs, and financing mechanisms or tied to broader trade concessions. Nations eager to avoid being the next target of US ire, or those seeking to capitalize on a closer relationship with a resurgent Washington, will likely comply.

For all the euphoria associated with the opening of potential markets or commercial opportunities, it is prudent to recognize the uncertainty that surrounds the current context. While the market may reward quick actions, the volatility of these situations may result in costly undertakings. Caution may be in order.

Long-Term Implications: Fragmentation and Resentment

While the US may achieve short-term market gains through these new interventions into the Latin American markets, the long-term implications are far more nuanced and complex.In a region where 70% of care is delivered by the public sector and where budgets are tight, market drivers (such as pricing) will be difficult to displace. It is unlikely that Latin American nations will completely abandon their commercial ties with China, even under US pressure.

While American products may regain some lost ground, Chinese manufacturers are unlikely to be completely dislodged. Instead of favoring American products for their technological or commercial benefits, we may see countries hedging their bets by buying American high-tech equipment to appease Washington while quietly continuing to source consumables and mid-tier technology from China to keep their budgets manageable.

Furthermore, heavy-handed tactics breed resentment. While Latin American nations may bend to US pressure temporarily, they will likely seek to regain strategic autonomy over the long term.

China, too, will adapt. Rather than just selling exports, Beijing may deepen its strategy by localizing production within Latin America, bypassing trade barriers and embedding itself deeper into the regional economy through technology transfers that the US has historically been reluctant to offer.

Navigating a New World Order

The capture of Nicolás Maduro and pressure on key allies mark a definitive turning point in US-Latin American relations. The era of passive competition is over. Ultimately, the power shifts in Latin America are not merely political maneuvers; they are economic earthquakes with profound implications for everyday commerce.

The medical equipment market serves as a vivid microcosm of this larger struggle, where geopolitical aspirations directly intersect with public health needs and commercial interests. The coming years will undoubtedly witness a delicate dance of diplomacy, economic incentives, and strategic partnerships as Latin American nations navigate a world increasingly shaped by the competing ambitions of global superpowers.

Next Steps

Position your brand for the LatAm pivot. As Washington reasserts dominance in the region, the medical device and pharmaceutical sectors face their most significant disruption in years. Gain clarity on emerging trends and market access risks with GHI’s expert research. Contact us today to see how our data can help you stay ahead of the competition.