Discover which hospitals in Argentina, Brazil, Central America, Chile, Colombia, Mexico, and Peru possess the largest amounts of leading-edge medical equipment.

By Guillaume Corpart

According to MedTech Outlook: Latin America 2023, the penetration of specialized medical equipment in Latin America’s hospitals remains a niche opportunity requiring a specific and targeted approach. Robotic surgery systems (RSS) and Linear accelerators (LINACs) are amongst the scarcest equipment, present in 1% of hospitals across the region. Other specialized medical equipment, such as C-arms, are present in 12% of hospitals in Latin America.

Beyond the modest penetration of specialized medical equipment, the market outlook in Latin America remains robust:

- The surgical robotics market is set to grow with a CAGR of 10.6% between 2021 and 2028

- The CT scanner market is projected to grow by 4.7% between 2022 and 2027

- The C-arms market is forecast to grow by 3.2% between 2022 and 2027

- The mammography market is set to grow by 6.9% between 2022 and 2027

Growth Drivers

One reason for these robust growth projections is the critical role that Latin America’s leading hospitals play. In the region’s largest markets – Brazil, Mexico, Colombia, Argentina, and Chile – certain hospitals stand out by their level of care and their acquisition of sophisticated medical equipment used to diagnose and treat complex conditions.

In our recent report, MedTech Outlook: Latin America 2023, we included a list of the top 10 MedTech leaders in several key markets:

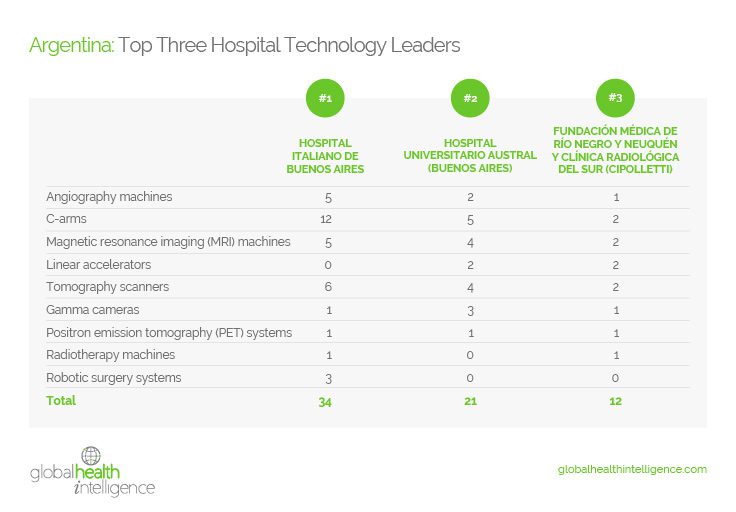

- Argentina

- Brazil

- Central America

- Chile

- Colombia

- Mexico

- Peru

We designated these hospitals as technology leaders due to their currently reported amounts of leading equipment types, such as:

- Angiography machines

- C-arms

- CT scanners

- Gamma cameras

- Linear accelerators

- MRI machines

- Positron Emission tomography (PET) systems

- Radiotherapy machines

- Robotic surgery systems

Below we break down the major tech leaders in these key markets.

To identify the tech leaders in Argentina, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Brazil, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Central America, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Chile, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Colombia, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Mexico, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

To identify the tech leaders in Peru, as well as 1,000 other strategic data points about Latin America’s medical equipment market, click here to purchase the MedTech Outlook: Latin America 2023 report.

What’s Next for the Medical Equipment Market in Latin America?

The pandemic has obliged medical equipment and medical device manufacturers to continuously monitor and track the market to detect early warnings that could result either in risks or opportunities. Market segmentation is critical in helping medical equipment and medical device manufacturers better assess their markets and craft distribution strategies to reach specific clients. Segmentation based on hospital demographics is one of several paths that can be explored.

Monitoring of the evolution of market size, either in number of units or value, is also critical to detect shifts and trends in the market. As the pandemic has proven, monitoring market share is the only true metric of success for leading established medical equipment and medical device manufacturers

Next Steps

Contact GHI if you want to know more about how we can help you gain a greater understanding of Latin America’s medical equipment market via our different market intelligence solutions.