Mexico entered into a mild recession in 2019, with negative GDP growth in the first two quarters of the year and a flat performance in Q3. There is, however, optimism for 2020, with 1.1% projected growth, according to some analysts.

According to ShareScope, a service from Global Health Intelligence (GHI) that analyzes import data and uses it to analyze market size & share for medical equipment and device brands in Latin America, 2019 figures show both positive and negative results, depending on the area of focus and product type.

2019 Medical Device Market Analysis for Mexico

To analyze the direction of Mexico’s market this year, ShareScope focused on the imports of specific types of medical devices and equipment, specifically:

- Electrocardiographs

- Ultrasound machines

- Magnetic resonance imaging equipment

- Equipment used in orthopedics/treatment of fractures

- Artificial joints

- Heart valves

- Pacemakers

- Computed tomography (CT scanners)

- X-ray machines

- Radiography/Radiotherapy equipment

While this is not an exhaustive list of all medical equipment imported into Mexico in 2019, it represents the major categories in terms of overall volume; as such, it serves as an overall indicator for the market in general.

Why Import Data?

ShareScope analyzes import data as a proxy for sales. This is because few products are manufactured locally and therefore imported medical devices and equipment are sold to medical institutions. As such, import data for medical devices and equipment are strongly correlated to actual sales and thus are a solid indicator of market activity.

Defining “Equipment” and “Devices”

It’s important to note that the import data analyzed by ShareScope are not just

the medical equipment and devices themselves, but also their parts and

components.

2018-2019 Decreases in the Mexican Medical Devices/Equipment Market

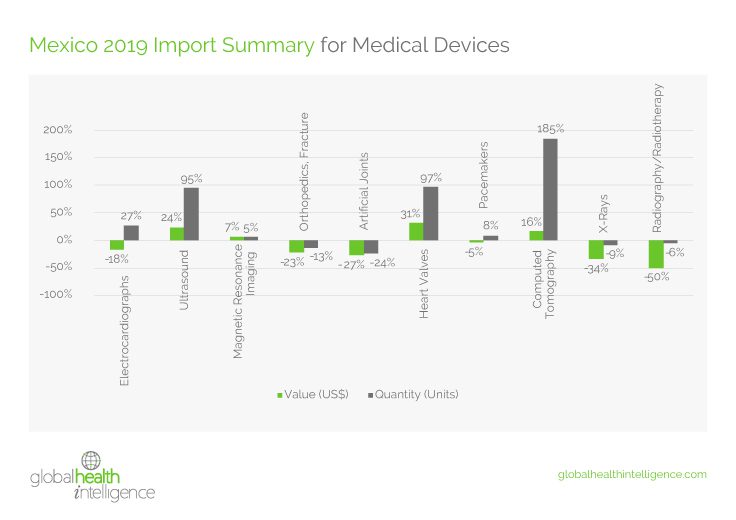

The chart below breaks down the CAGR for 2014-2019 for these categories, as well as a year-to-year comparison for 2018-2019. It features the difference in both value and quantity in terms of equipment.

For 2018-2019, we forecast a few drops in quantities:

- 24% decrease in the importation of artificial joints

- 13% decrease in the importation of equipment for orthopedics/fracture treatment

- 9% decrease in the importation of X-ray machines

- 6% decrease in the importation of radiography/radiotherapy equipment

However, as we will show below, a number of equipment/device categories posted strong increases in Mexico in 2019 in terms of quantities.

In fact, overall, we forecast a 9% increase in the quantities of medical devices/equipment imported into Mexico in 2019.

That said, we forecast significant drops in the value of medical equipment imported into Mexico in 2018-2019, specifically:

- 50% decrease in the importation of radiography/radiotherapy equipment

- 34% decrease in the importation of X-ray machines

- 27% decrease in the importation of artificial joints

- 23% decrease in the importation of equipment for orthopedics/fracture treatment

- 18% decrease in the importation of electrocardiographs

Overall, we expect to see a 9% decrease in the value of imported medical devices and equipment into Mexico in 2019.

2018-2019 Increases in the Mexican Medical Devices/Equipment Market

Despite these downturns, a number of equipment categories posted increases. First, there was an encouraging jump in quantities:

- 185% increase in the importation quantities of computed tomography machines/parts

- 97% increase in the importation quantities of heart valves

- 95% increase in the importation quantities of ultrasound machines/parts

- 27% increase in the importation quantities of electrocardiograph machines/parts

- 8% increase in the importation quantities of pacemakers

- 5% increase in the importation quantities of MRI machines/parts

In addition, we forecast an increase in the value of certain medical devices/equipment imported into Mexico during the 2018-2019 period:

- 31% increase in the importation value of heart valves

- 24% increase in the importation value of ultrasound machines/parts

- 16% increase in the importation value of computed tomography equipment/parts

- 7% increase in the importation value of MRI machines/parts

Interpreting the Results

While other markets faced difficulties during the 2014-2019 period (referred to by some as Latin America’s “lost half decade”), Mexico’s medical device/equipment market actually posted positive numbers during that period:

- A CAGR of 2% growth in value

- A CAGR of 12% growth in quantities

In general, what we’re seeing with Mexico is generalized margin compression in the order of 22% (weighted average). These results are in line with AMLO’s policies to reduce healthcare expenditure by consolidating tenders, buying from manufacturers and allowing more foreign competition.

Uncovering Opportunities

With Latin America’s second-largest market posting these mixed results, it becomes ever more important for medical device and equipment manufacturers to be analytical in finding new opportunities.

While existing contacts and prospecting are important, sales teams need to leverage more tools, such as:

- Overall market sizing and its trends

- Independent and unbiased market share tracking

- Streamlining CRM systems to integrate data from multiple sources into one platform the whole team can use

- Discovering new accounts that are ideal for high-end, cutting-edge medical devices

- Determining market demand outside of your regular client base

This analytical approach is helpful for all markets, but much more in markets like Mexico, in which data can make the difference between exceeding your sales goals and falling considerably short.

Contact us to find out more about how we can help you expand your sales in Mexico.