By Guillaume Corpart

The COVID-19 pandemic had a profoundly intricate effect on global and regional healthcare markets and changed how medical equipment importers in Latin America procured their products (read Part 1 of this analysis here). To understand this, we will examine the shifting import trends in several Latin American countries.

Regional Breakdown

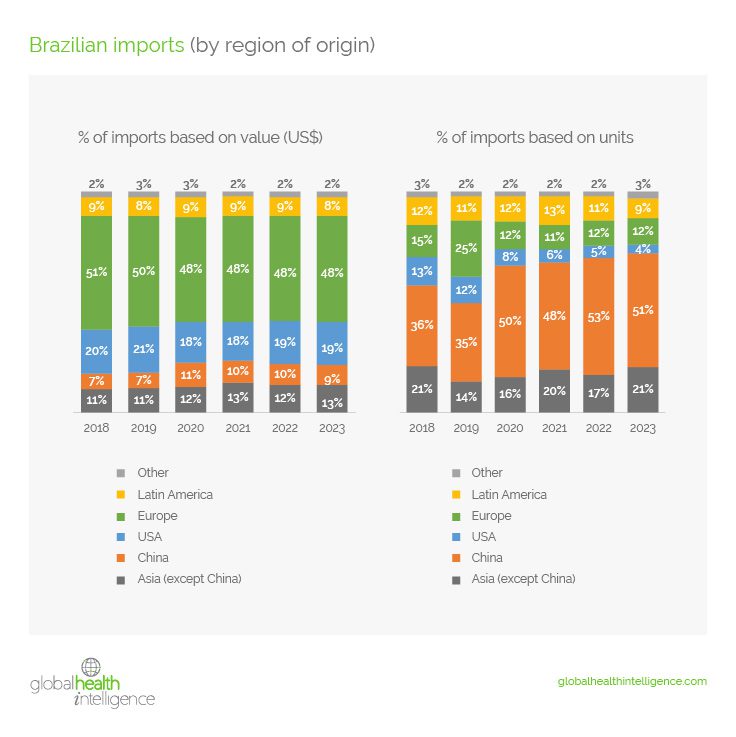

Brazil

Among the Latin American hospital markets, Brazil is the largest in both the number of hospitals and number of patients. In total, they have over 6,500 hospitals attending to over 215 million people.

Import Value:

- Asian products represented 18% of the value of all Brazilian imports for medical products before COVID and grew to represent 22% in 2023.

- In contrast, the value share of products from Europe dropped from 51% to 48% over the same period. Meanwhile, products from the U.S. dropped slightly, from 20% to 19%.

Import Volume:

- Asian products represented 57% of the volume of all Brazilian imports for medical products before COVID and grew to represent 72% in 2023.

- China is the main beneficiary of this trend, growing its share of imports from 36% in 2018 to 51% in 2023. The rest of Asia remained stable.

- In contrast, the volume share of products from the U.S. dropped from 13% to 4% over the same period. Products coming from Europe and other Latin American countries also suffered a contraction over the same period, but not as stark as that of the United States.

Key takeaways

China is gaining ground when it comes to selling medical products into Brazil at the detriment of manufacturers based in America, Europe, and other Latin American countries. The steep rise in quantity of imports from China, coupled with only a modest rise in value of imports, could indicate that China is introducing more goods at lower prices.

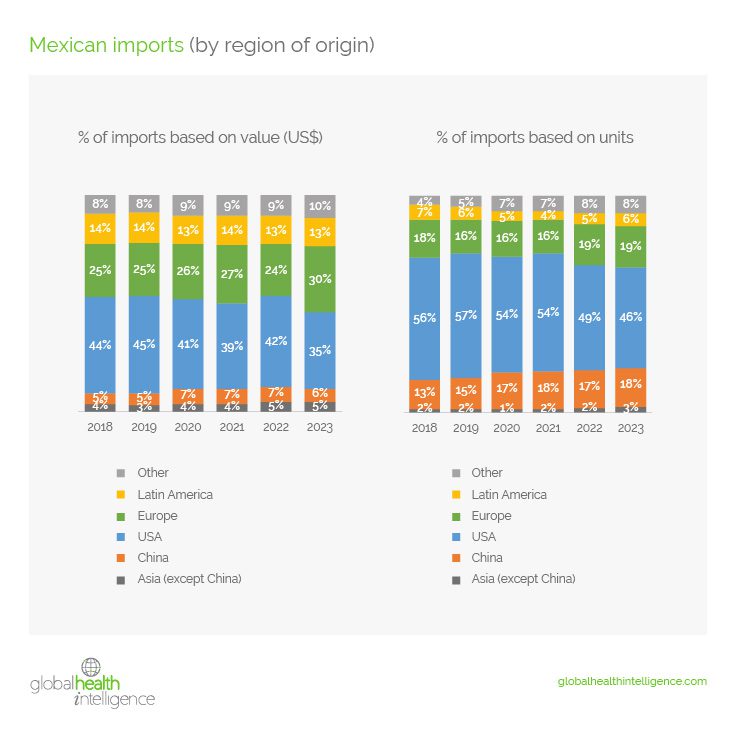

Mexico

Mexico is the second largest hospital market in Latin America, with over 3,500 hospitals attending to over 125 million people. Proximity to the United States, combined with a strong industrial base, make Mexico a natural trading partner for the U.S. This is particularly true considering the current G2 tensions and nearshoring trends.

Import Value:

- Asian products represented 9% of the value of all Mexican imports for medical products before COVID and grew to represent 11% in 2023.

- Products from the United States represented 44% of the value of imports before COVID and dropped to 35% in 2023. Meanwhile, the value share of products from Europe increased from 25% to 30% over the same period.

Import Volume:

- Asian products represented 15% of the volume of all Mexican imports for medical products before COVID and grew to represent 21% in 2023.

- China is the main beneficiary of this trend, growing its share of imports from 13% in 2018 to 18% in 2023, while the rest of Asia remained relatively stable.

- In contrast, the volume share of products from America dropped from 56% to 46% over the same period. Products coming from Europe and other Latin American countries remained relatively stable proportionately.

Key takeaways

Historic relations, trade agreements, and geographic proximity, combined with a highly integrated manufacturing base, are all reasons why Mexico and the U.S. make natural trade partners. As a result, the influence of China is felt less strongly in Mexico than in the other countries of Latin America. That said, the United States is slowly losing its central role in the trade of medical equipment. On the value side, European players are displacing American products, while Chinese products are winning on the volume side of the equation.

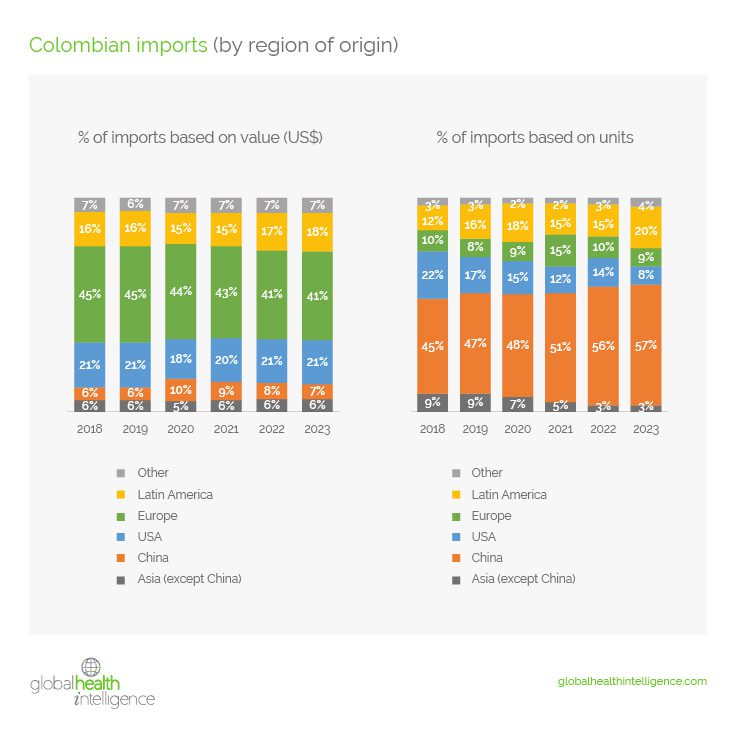

Colombia

The nation of Colombia remains a large and vital Latin American hospital market. In total, it has over 2,500 hospitals attending to over 50 million people.

Import Value:

- Asian products represented 12% of the value of all Colombia imports for medical products before COVID and grew to represent 13% in 2023. Simultaneously, imports from other Latin American countries went from 16% to 18% during the same period.

- In contrast, the value share of products from Europe dropped from 45% to 41% over the same period. Meanwhile, products from America maintained their position at 21% of all imports.

Import Volume:

- Asian products represented 54% of the volume of all Colombia imports for medical products before COVID and grew to represent 60% in 2023.

- China is the main beneficiary of this trend, growing its share of imports from 45% in 2018 to 57% in 2023, while the rest of Asia dropped from 9% to 3%.

- In contrast, the volume share of products from America dropped from 22% to 8% over the same period. The volume of medical products coming from Europe remained relatively stable, while the volume of products coming from other Latin American countries grew from 12% to 20%.

SELL MORE SURGICAL PRODUCTS

Identify the most common procedures at LatAm hospitals to target your sales

Key takeaways

China is gaining ground when it comes to the volume of medical products it is selling into Colombia, to the detriment of products coming from the United States. Meanwhile, the value share of medical products coming from the United States has remained stable. The innovation and technology of American products enables them to remain more resilient in sales, even though they are sold at lower volumes.

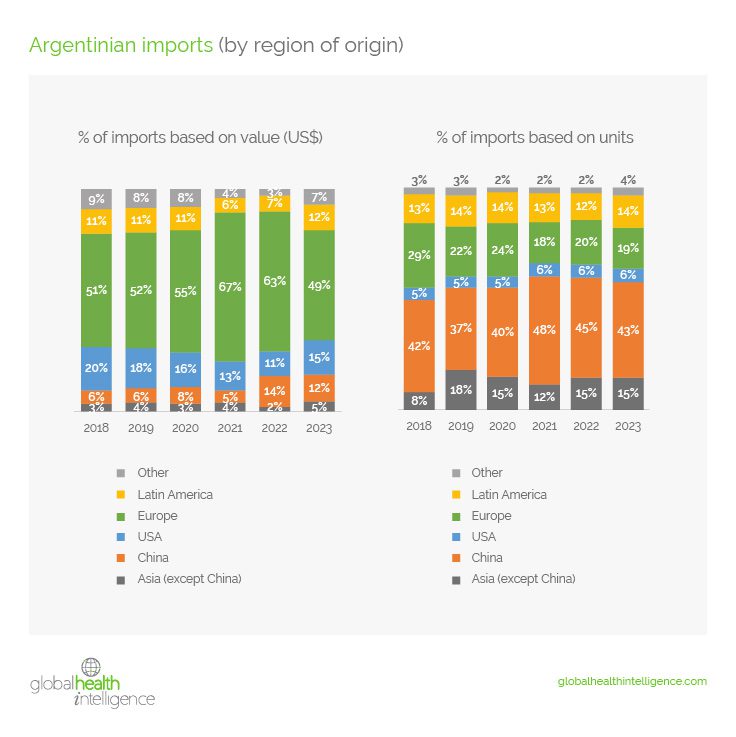

Argentina

The country of Argentina has over 2,300 hospitals that attend to over 45 million patients.

Import Value:

- Asian products represented 9% of the value of all Argentina imports for medical products before COVID and grew to represent 15% in 2023.

- In contrast, the value share of products from the United Stated dropped from 20% to 15%. The value share of products from Europe dropped from 51% to 49% over the same period.

Import Volume:

- Asian products represented 50% of the volume of all Argentinian imports for medical products before COVID and grew to represent 58% in 2023.

- Contrary to some other Latin American markets, Asian countries other than China were the main beneficiaries of this trend, growing their share of imports from 8% in 2018 to 15% in 2023. Products from China remained relatively stable.

- In contrast, the volume share of products from Europe dropped from 29% to 19% over the same period. Products coming from the United States and other countries held a similar share before and after COVID.

Key takeaways

Asian countries other than China are gaining ground when it comes to selling medical products into Argentina, at the detriment of manufacturers based in Europe. Products from other regions have similar penetration over the past five years. The economic uncertainty of Argentina makes it a challenging environment in which to do business, possibly skewing the regional trends of product penetration and sourcing.

Chile

Lastly, Chile is a relatively small hospital market, with 402 total institutions. Despite this, it outweighs many of the other geographies in Latin America due to the large size of its hospitals, as well as their high level of sophistication.

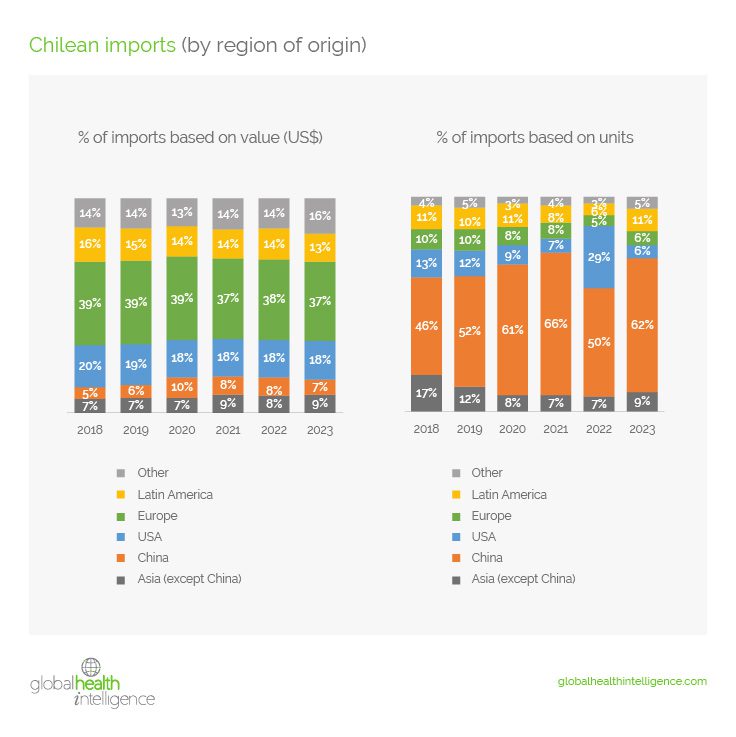

Import Value:

- Asian products represented 12% of the value of all Chile imports for medical products before COVID and grew to represent 18% in 2023.

- In contrast, the value share of products from Europe dropped from 39% to 37%. The value share of products from the United States dropped from 20% to 18% over the same period.

Import Volume:

- Asian products represented 63% of the volume of all Chile imports for medical products before COVID and grew to represent 71% in 2023.

- China is the main beneficiary of this trend, growing its share of imports from 46% in 2018 to 62% in 2023, while the rest of Asia contracted from 17% to 9% over the same period.

- In contrast, the volume share of products from America dropped from 13% to 6%, while products coming from Europe dropped from 10% to 6% over the same period.

Key takeaways

China is gaining ground when it comes to selling medical products into Chile, at the detriment of manufacturers based in the United States and Europe. The steep rise in quantity of imports from China, coupled with only a modest rise in value of imports, could indicate that China is introducing more goods at lower prices.

For more information

For all of these regional breakdowns, analysis by product category (pharmaceuticals, consumables, equipment, and devices) may vary. Contact GHI for a detailed analysis of your product category, as well as to understand market size and market share trends by product.