By Guillaume Corpart

In 2024, the global healthcare landscape appears to be poised for several transformative changes. The primary drivers of these changes are technological advancements, evolving patient expectations, and a renewed focus on public health. Here’s an overview of what you can expect in the year ahead.

The current state of LatAm healthcare

In a region where 70% of the population is reliant on the public sector for healthcare, economic context is critical to understanding the state and evolution of health services. First, it’s important to realize that it’s a region of tremendous growth potential.

Latin America posted 2.3% GDP growth in 2023, outpacing the growth of most developed economies. The region is poised for a similar year not only in 2024 but beyond, as well. This will likely be driven by the wave of nearshoring and the pent-up demand for natural resources, specifically the copper and lithium used in the production of electric vehicles (EVs).

Emerging trends

Along with this growth potential, we anticipate several changes, both technological and societal, driving the future of healthcare in the region. These are a few areas to potentially capitalize on in the coming year:

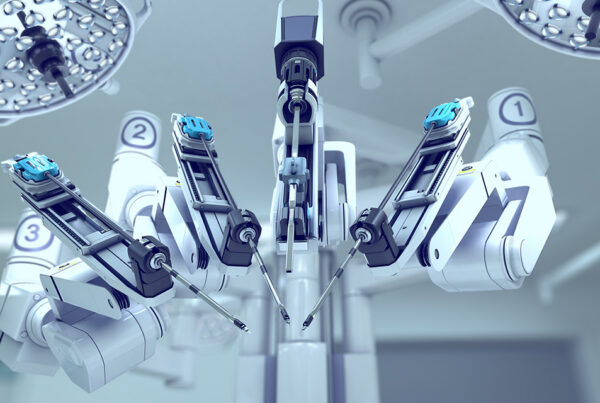

- The AI boom. Artificial intelligence (AI) will play a growing role in all sectors of the healthcare space, including innovation, product development, clinical research, testing, diagnostics, implementation, and patient interfaces. These advances will likely be adopted at a varying pace throughout Latin America, depending on demographic characteristics such as the nature of the sector, the type of institution, and the level of sophistication. Healthcare access and equity remain ideals that AI may seek to address, but only on the coattails of lucrative achievements.

- Demographic forces. The unstoppable force of demographics will play a central role in shaping demand for healthcare services over the next decade. From the obesity epidemic to the aging population, the most innovative healthcare solutions will come from private providers.

- Shifting global influences. Global factors such as G2 tensions, armed conflicts, and social unrest will continue to shape the socio-political context. As the world grapples with evolving health challenges, the healthcare outlook in 2024 reflects a dynamic landscape marked by innovation, inclusivity, and a commitment to improving overall population health.

The big-picture view

Before diving into the specifics of the year ahead, it helps to have a greater understanding of Latin America and where it stands with other world economic and healthcare markets.

Economic and social aspects

- GDP: US$ 3.1 T

- GDP growth:3%

- Population: 667 M people

- Urbanization: >80%

- Natural resources: 23% of forests, 30% of fresh water, and 25% of arable land worldwide

- Metals & minerals: 58% of lithium reserves and 41% of copper reserves worldwide

Healthcare

- Hospitals: >20,000

- Operating rooms: >53,000

- Hospital beds: >1.2 M

- Uniqueness: Hospitals in Latin America are smaller than their counterparts in the United States or Europe, resulting in the need to be adaptable in medical offerings, financing, and distribution.

- Regional differences: Healthcare systems (and their sophistication) vary by country, with public and private systems operating in parallel.

Economic outlook

Since the start of the COVID-19 pandemic, each year has been marked by a key event that has shaped most of our lives in the West.

Moments that marked the year

- 2020: COVID lockdowns and uncertainty.

- 2021: Global vaccinations and working from home.

- 2022: The world opens up again, leading to both stimulus and inflation.

- 2023: A gradual return to fundamentals.

- 2024: Slow and stable growth as we build toward 2025.

Despite widespread recession fears going into 2023, the year was surprisingly robust. It surpassed expectations and exceeded anticipated performance as global GDP grew 3.0%.

In general, Latin America’s economic performance in 2023 was better than expected. The region demonstrated 2.3% GDP growth during the period. While this underperformed the global average, it outperformed developed economies such as the United States and Europe.

The inflationary spiral of 2021-2022 also slowed during 2023, with nearly every country showing lower inflation than the previous year. Argentina remains an outlier to this trend, unfortunately, and its economic crisis continues. (Refer to this article for more insight on Argentina)

As the risk of recession fades and inflation drops, the Federal Reserve projects three rate cuts in 2024. Simultaneously, demand for products and services remains high and employment remains strong, bolstering consumption. Healthcare remains a critical sector with vast transformative development prospects, whether this be through the development of AI solutions or innovations to meet demographic burdens.

A return to normalcy

On a corporate level, 2023 will be remembered as the “return to fundamentals” as corporations reset their operations and sought to normalize their activities in the aftermath of the COVID crisis and the massive fiscal and monetary stimulus measures that ensued. Rising financial costs became a burden for both early-stage medical firms and leveraged balance sheets. This impacted the ability to spend on additional market expansion and regularize M&A activity.

The “COVID bonus” came to an end as personal protective equipment (PPE) manufacturers, pandemic vaccine makers, and telehealth providers experienced a rapid slowdown in their activities. We expect to see a continued normalization of growth in 2024 and into 2025, with an overall improvement in balance sheets. Commodity price performance could be mixed but generally supportive for the region.

Nation-by-nation outlook

Going into 2024, Latin America’s growth is forecast at 2.3%, on par with 2023. Regional differences will present unique opportunities within each country, which may require the adoption of a country-level strategy.

- Argentina: Expect a possible rebound from the economic contraction of 2023. The shock therapy of the Milei government may result in more “open market” opportunities, but it may also result in large sacrifices and economic hardship. The situation remains fluid, and the outlook is uncertain, warranting continued and diligent monitoring of the market.

- Brazil: As the largest economy in Latin America, representing 33% of the regional GDP, you can expect slow economic performance in 2024. GDP growth is expected to be below 2%. The legislative focus seems to remain on structural reforms and ongoing debates over the fiscal balance.

- Chile: A strong demand for natural resources will continue to support economic growth. Most notable among these resources are copper, which is used for sustaining the grids that electrical vehicles (EVs) use to charge, and lithium, a central component in EV batteries.

- Colombia: Unfortunately, Colombia is expected to face a cloud of policy uncertainty in 2024.

- Mexico: As the second-largest economy in Latin America and a premier trading partner with the United States, Mexico will continue to benefit from nearshoring trends. Elections in 2024 will likely help loosen fiscal purse strings.

- Panama: As a solid economy with a sophisticated healthcare sector, Panama remains a niche market for medical equipment and device manufacturers.

- Peru: After Chile, Peru is the world’s second-largest copper producer. The nation will benefit from heightened international demand as EVs continue to expand their presence.

Inflation and average consumer prices

Percent change

| 2021 | 2022 | 2023e | 2024f | |

| USA | 4.7% | 8.0% | 4.1% | 2.8% |

| China | 0.9% | 1.9% | 0.7% | 1.7% |

| Argentina | 48.4% | 72.4% | 121.7% | 93.7% |

| Brazil | 8.3% | 9.3% | 4.7% | 4.5% |

| Chile | 4.5% | 11.6% | 7.8% | 3.6% |

| Colombia | 3.5% | 10.2% | 11.4% | 5.2% |

| Mexico | 5.7% | 7.9% | 5.5% | 3.8% |

| Panama | 1.6% | 2.9% | 1.5% | 1.9% |

| Peru | 4.0% | 7.9% | 6.5% | 2.9% |

| Puerto Rico | 2.4% | 5.9% | 2.9% | 1.5% |

Source: IMF, World Economic Outlook.

GDP growth

Percent change

| 2021 | 2022 | 2023e | 2024f | |

| USA | 5.8% | 1.9% | 2.4% | 1.6% |

| China | 8.5% | 3.0% | 5.5% | 4.0% |

| Argentina | 10.7% | 5.0% | -2.5% | 2.8% |

| Brazil | 5.0% | 2.9% | 3.2% | 1.5% |

| Chile | 11.7% | 2.4% | -0.5% | 1.6% |

| Colombia | 11.0% | 7.3% | 1.4% | 2.0% |

| Mexico | 5.8% | 3.9% | 3.2% | 2.1% |

| Panama | 15.8% | 10.8% | 6.0% | 4.0% |

| Peru | 13.4% | 2.7% | 1.1% | 2.8% |

| Puerto Rico | 0.4% | 3.4% | -0.7% | -0.2% |

| Latin America | 7.0% | 3.9% | 2.3% | 2.3% |

Source: IMF, World Economic Outlook, Citibank.

What to expect for the year ahead

- Growth optimism. Anticipate moderate growth for the initial part of 2024, with a sense of renewed invigoration toward the latter part of the year and into 2025.

- Rising profits. Corporate profits should rise 5% from 2023 to 2024 and again 7% from 2024 to 2025.

- Varied opportunities. Latin America will offer sustained growth perspectives in 2024, with unique opportunities in each country.

- Economic strength. Global economic growth will strengthen in 2025.

Next Steps

Contact GHI to learn more about emerging trends in healthcare for the year ahead and how your sales and marketing team can plan ahead and uncover opportunities within Latin America’s medical device and equipment sector.